The poor you will always have with you. (Matthew 26:11)

Another thing you will always have with you: lenders making high-interest, short-term loans to the poor, who will then struggle to pay them back. Which leads to yet another eternal condition: impractical moral judgements about said loans. Condemnation of usury can be found throughout the sacred scriptures of Christianity, Islam and Judaism, as well as in ancient Greek and Roman law. In the 6th century AD, Byzantine emperor Justinian tried to help the poor by limiting loan interest to 4 percent. The moneylenders ignored him.

Not much has changed since ancient times. In this year’s federal budget, the Liberals declared they too were “cracking down” on “predatory lenders who can take advantage of some of the most vulnerable people in our communities, including low-income Canadians, newcomers, and seniors.” To this end, Budget 2023 reduces the maximum legal rate of interest and imposes a new lower national fee structure on so-called “payday” loans.

These changes have been hailed as a victory by poverty activists who claim poor Canadians will now save millions of dollars in interest thanks to being protected from unscrupulous lenders. True, some borrowers – those who have decent credit scores, or are close – may soon find their borrowing costs slightly reduced. But millions of Canadians live from paycheque to paycheque with no hope of getting a loan at anything close to bank rates. When they suffer a financial crisis, they must either rely on friends or relatives to help them out, or seek more expensive sources of credit from non-bank lenders. By making it harder for these credit providers to operate, Ottawa risks severing this important financial lifeline. And then what?

The crackdown by Prime Minister Justin Trudeau’s government on legal, high-interest lenders will not make life better for a great many vulnerable people. Rather, it will push them into the hands of unregulated, illegal operators who charge much higher rates and regularly abuse their clients in ways that legal lenders do not. Such are the unintended consequences of taking a moralistic stand against market forces.

And it’s not limited to payday loans. The tobacco and cannabis industries offer further evidence of sanctimonious federal government policy forcing entrepreneurs to give ground to criminal organizations and leading to poorer outcomes for consumers. With its habit of signalling virtuously while taxing and regulating heavily – and then showing no interest in enforcing the law for those who break it – the Trudeau government is proving to be the black market’s best friend.

Running the Numbers

Prior to Budget 2023, Canada’s “criminal rate of interest” was 60 percent. This rate, set in 1980, is based on earned interest compounded monthly and is equivalent to a 47 percent interest rate calculated using the more familiar annual percentage rate (APR) method. Once the necessary regulations for the budget are proclaimed (expected shortly), the criminal interest rate will drop to 35 percent APR. It will henceforth be illegal to charge more than this rate. With one exception.

In 2007 the minority Conservative government of Prime Minister Stephen Harper allowed the provinces to take over the regulation of payday loans. These are short-term loans for no more than $1,500 which must be paid back in full within 62 days. Their intent is to provide cash-strapped workers with immediate access to credit to cover unexpected expenses before their next paycheque arrives. Their name comes from the original practice of having the borrower write a post-dated cheque repaying the loan on their next payday. The criminal rate of interest includes a specific exemption for payday loans, with the fees being calculated as dollars per $100 borrowed rather than as a percentage. The maximum allowable rate currently ranges from $17/$100 in Manitoba, Saskatchewan and Nova Scotia to $14/$100 in Newfoundland and Labrador. Budget 2023 imposes Newfoundland’s rock-bottom rate across the whole country.

Given their high risk and unsecured nature, the effective rate of interest for payday loans is very high. On an APR basis, even Newfoundland’s countrywide lowest fee of $14/$100 works out to a staggering 364 percent, or more than ten times the proposed new criminal interest rate. Such a huge gap in legal interest rates strikes many observers as unprincipled. But not all critics want to see them eliminated.

“Payday loans are a terrible option,” admits Brian Dijkema, vice president of external affairs at Cardus, a Canadian social-policy think-tank. In a world obsessed with fairness, it seems particularly unfair that low-income Canadians must pay many times more than posted mortgage rates simply to borrow a few hundred bucks. And because of the short payback period, it is not uncommon for desperate borrowers to take out a second loan to pay off the first, leading into a debt spiral that can quickly get out of control. Half of Canadians who went through personal bankruptcy last year had at least one payday or similar short-term loan; the average was four. As bad as they may be, however, Dijkema believes payday loans are “often better than the alternative.”

According to recent survey by Statistics Canada, more than one-quarter of Canadians say they would be unable to cover an unexpected expense of $500. Similarly, 8 million adult Canadians are considered “non-prime” borrowers because of poor credit scores, with an additional 300,000 having no credit score at all. This means a sizeable chunk of Canada’s population cannot simply walk into a bank and get a loan, line of credit or credit card whenever they need it. Going to an alternative lender who charges exorbitant rates may thus make sense. “If you’re about to lose your job because you can’t get your car fixed, or your electricity is about to be cut off, then a payday loan can be a very rational choice,” says Dijkema in an interview.

Asked about the implications of a new nationally imposed rate of $14/$100, the Canadian Consumer Finance Association predicts that ‘borrowers will lose access to licensed, legal lenders as more lenders exit the market and those that remain restrict their lending criteria.’

That is also the position of the Canadian Consumer Finance Association (CCFA), which represents the payday loan industry. “Our members exist because there is a demand for credit that is not fulfilled by banks and other traditional lenders,” the organization said in a statement. The CCFA no longer has an official spokesperson and has largely given up participating in public policy debates because of its habitual vilification by the media and politicians. The organization agreed to provide written answers to questions posed by C2C Journal. “No one denies that the cost of credit is high but that is because the cost to provide credit is high,” said the statement from an unidentified CCFA representative. The organization cites high operating costs, high costs of capital (those payday lenders must borrow the funds they lend out) and numerous bad debts as necessitating the hefty rates.

Asked about the implications of a new nationally imposed rate of $14/$100, the CCFA predicts that “borrowers will lose access to licensed, legal lenders as more lenders exit the market and those that remain restrict their lending criteria.” The group points to Newfoundland as proving its case. “No company to our knowledge is solely a payday lender in NFLD,” the CCFA stated. “They would not be able to survive.” An analysis of the payday loan industry by York University finance professor Chris Robinson in 2018 concluded that a $15 fee was likely the minimum sustainable rate for the industry.

Until Budget 2023, payday loan rates were a provincial responsibility and subject to intense scrutiny by legislatures. Several years ago, following detailed public reviews, Ontario and Alberta both lowered their maximum allowable rate to $15/$100. Now the federal government has forced its way back onto this file, and without any serious consultation. While Justice Minister David Lametti admitted in a recent Senate hearing that payday loans are a “sad necessity” for many borrowers, the rate chosen by Ottawa appears designed to kill the industry by stealth.

The provinces’ lack of pushback to this usurpation of their authority on payday loans remains unexplained. In response to a question about provincial participation, federal Finance Department spokesperson Caroline Feggans told C2C Journal, “The Government of Canada welcomes the support of provinces and territories as it strengthens consumer protection from predatory lending practices for vulnerable Canadians.” In other words, the feds don’t care what the provinces think.

But Ottawa’s plan to render payday lenders unprofitable will not improve consumer protection or resolve the underlying problem that many Canadians cannot get a bank loan or credit card. It will simply force them elsewhere in times of financial crisis. “When you get rid of one option for credit, the demand does not disappear,” Dijkema observes. “People will need to find other ways.” Cardus has long promoted socially-conscious lending programs operated by credit unions as a replacement for payday lenders. Yet Dijkema admits this concept has so far proven a huge disappointment. In Alberta, such loans make up a negligible 0.09 percent of lending activity. Usury remains the only practical option.

From Loan-Sharks to Loan-Badgers

Quebec offers a case study into the consequences of going without a legal payday lending industry. The province did not participate in the Harper government’s 2007 provincialization of payday loan regulation and as a result makes no exemption for these loans. Instead, the federal criminal rate of interest applies across all legal lending activity. But this doesn’t mean Quebeckers don’t need – or don’t have access to – short-term, high-interest loans. It just means all this business occurs illegally in the unregulated black market.

To get a handle on the scale of the problem in Quebec, the Canadian Lenders Association (CLA) provided C2C Journal with the results of its “web scraping” investigation that identified 68 unregulated lending websites operating since 2013 that have targeted Quebeckers with high-interest, short-term loans. Some of them appear to be hosted within Canada, while others are located offshore in Malaysia, Panama and France. Their posted interest rates range as high as 634 percent APR, far in excess of what legitimate payday lenders are allowed to charge in other provinces. It is no surprise that the CLA, which represents over 250 legitimate alternative credit providers across Canada (with the exception of payday lenders), is strongly opposed to the recent reduction in the criminal rate of interest to 35 percent.

In the past, illegal loan sharks used the threat of broken kneecaps or thumbs to extract repayment from recalcitrant clients. This new breed of online collectors prefers verbal violence by phone.

The growth of illegal online lending is not limited to Quebec. Doug Hoyes is a principal in Ontario-based insolvency trustee firm Hoyes, Michalos & Associates. In past decades, most of Hoyes’ clients arrived with unmanageable credit card or bank debt. Lately, however, Hoyes says payday and other rapid loans figure much more prominently in bankruptcy proceedings. And many of these debts are of uncertain provenance. He has identified over 1,000 websites to which his clients owe money, noting, “The vast majority of these creditors did not file a proof of claim.” This suggests they are unregulated, and hence illegal. But just because a lender doesn’t have legal standing doesn’t mean they’re prepared to give up when a debtor files for bankruptcy. According to Hoyes, they want to be repaid in full.

In the past, illegal loan sharks used the threat of broken kneecaps or thumbs to extract repayment from recalcitrant clients. This new breed of online collectors prefers verbal violence by phone. Old-school physical loan sharking is thus being replaced by phone-based loan badgering. “They will call your home, they will call your mother, they will call your boss,” Hoyes says. Often hundreds of times a day. “They will keep badgering you until you pay. And there is no way to block them, because they use unlisted numbers.” It is a surprisingly effective strategy, he says: “In a lot of cases, the client will actually pay the $700 they owe because they simply can’t take the harassment.” As having a job is a requirement for getting an online payday loan, targeting a debtor’s boss with a barrage of daily calls often proves to be the final straw.

Despite ample evidence that the true predatory lenders are illegal, online operators, Ottawa shows no interest in cracking down on them. Hoyes recently submitted proof to federal authorities that one of his clients had been paying an illegal rate of interest. “I never heard back,” he says glumly. A recent Globe and Mail report bounced between the RCMP, the Financial Consumer Agency of Canada and the Office of the Superintendent of Bankruptcy when it tried to figure out who has responsibility for investigating illegal online lending. “If you believe that legislation can solve problems associated with lending, then you have to be prepared to enforce it,” says Hoyes. “But there is no political will to do that.”

Up in Smoke

Alongside payday lenders (and perhaps mosquito breeders), cigarette manufacturers are another of Canada’s most-hated industries. And they offer a further example of how federal Liberal animosity towards legal businesses aids their illegal competitors.

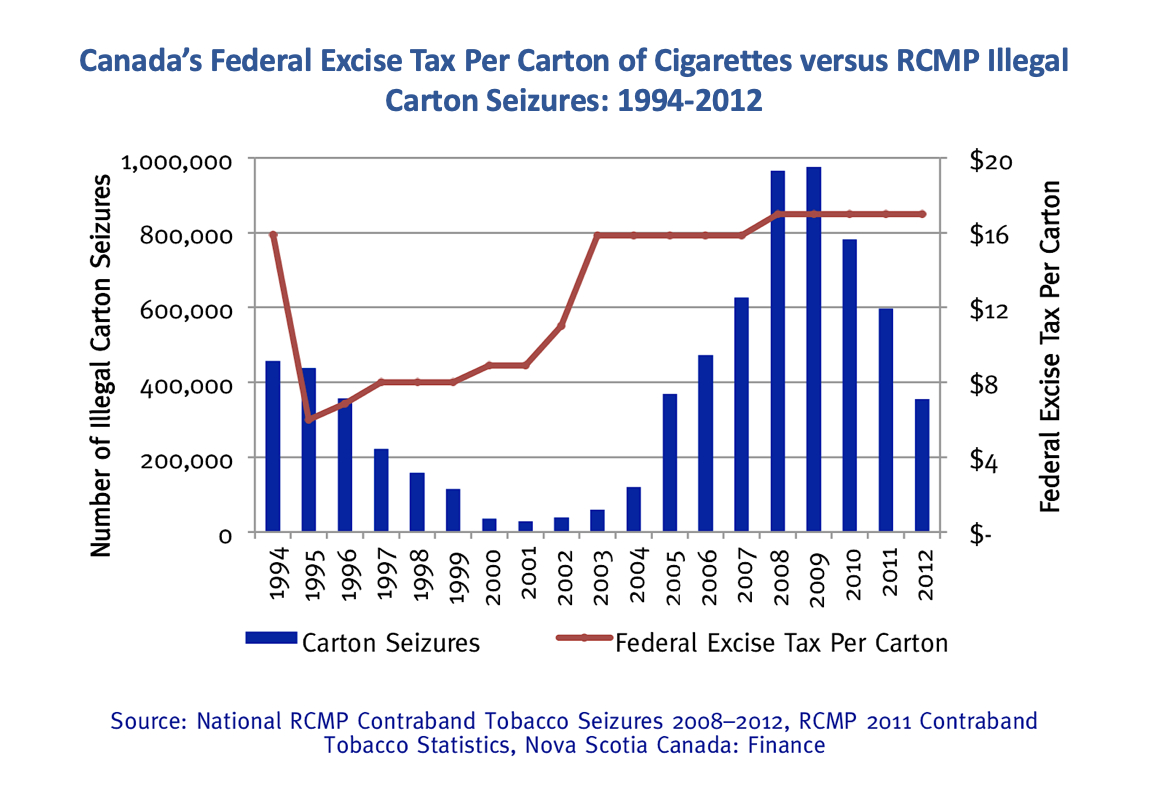

The connection between government taxes and illicit cigarette manufacturing and smuggling is among the best-established relationships in Canadian public policy. Following substantial hikes in federal and provincial excise taxes on tobacco for public health reasons in the 1980s and early 1990s, organized crime became heavily involved in selling contraband cigarettes across the U.S. border. The resulting crime wave caused chaos in the affected cities. The open lawlessness and at-times-daily shootings prompted the New York Times to dub Cornwall, Ontario (located on the St. Lawrence River across from New York state) “Dodge City East.”

In 1994, the Liberal government of Prime Minister Jean Chrétien responded by slashing federal tobacco taxes nearly in half from $10.36 to $5.36 per carton. Many provinces acted likewise. Criminal activity immediately declined. Lower taxes proved to be a remarkable policy success. By the mid-2000s, however, successive governments forgot these lessons and resumed hiking cigarette taxes, spurred on by aggressive demands from lobby groups such as the Heart & Stroke Foundation, Canadian Cancer Society and Physicians for a Smoke-Free Canada. As taxes grew again, so did tobacco smuggling and the black market. A joint Reason Foundation/Canadian Taxpayers Federation policy brief from 2014 concluded there is “strong empirical evidence from the period 1994-2008 to support the contention that higher cigarette taxes encouraged illicit trade, while lower cigarette taxes discouraged it.”

Today, tobacco taxes continue their upward climb, along with the good times for illegal manufacturers and smugglers. According to Eric Gagnon, vice president of legal and external affairs for Imperial Tobacco Canada, unregulated, illicit cigarettes account for approximately one-third of the Canadian market. To underscore his point, Gagnon has a habit of describing his firm as “the largest legal tobacco manufacturer in Canada.”

Gagnon identifies two ways current federal policies strengthen the black market. First, heavy-handed regulation allows illegal providers to satisfy consumer demands in ways the legal market cannot. This includes such things as a ban on menthol cigarettes, packaging rules that require horrifying pictures of diseased lungs on the front of packs and – the federal government’s latest health policy innovation – health warnings on each individual cigarette. Unregulated sellers abide by none of these rules. “This creates business opportunities for illegal marketers,” Gagnon says in an interview.

Second, unsurprisingly, is price. Approximately three-quarters of the price of a pack of smokes is comprised of taxes meant to discourage consumption. And criminals don’t pay taxes. “In B.C. a carton will cost you $175,” says Gagnon. “You can get the same number of cigarettes for about $45 from an illegal dealer. The incentive for consumers is huge.”

The Mounties identified 43 illegal cigarette manufacturing plants on reserves in Kahnawake, Quebec, and Tyendinaga and Six Nations, Ontario as the main sources of contraband. The report further noted that approximately 100 national organized crime groups were ‘involved in the trade of illicit tobacco.’

Similar to complaints from the legal payday loan industry, Gagnon says he’s frustrated by the lack of interest most governments show in cracking down on illegal activity. In fact, the Trudeau government seems intent on making things easier, not harder, for the criminals. Last year’s amendments to the Criminal Code, for example, reduced Harper-era mandatory minimum sentences for tobacco smuggling. Meanwhile, Imperial Tobacco is in insolvency protection due to government and class action lawsuits totalling over $500 billion that seek to put it out of business permanently.

At Home on Native Land

One explanation for the Liberals’ reluctance to tackle the illegal cigarette business in Canada is that it’s largely an Indigenous-based enterprise. A 2009 RCMP task force into tobacco smuggling reported that, “Since 2001, the largest quantity of illicit tobacco found in Canada has flowed from manufacturing operations based on Aboriginal reserves and territories.” The Mounties identified 43 illegal cigarette manufacturing plants on reserves in Kahnawake, Quebec, and Tyendinaga and Six Nations, Ontario as the main sources of contraband.

The report further noted that approximately 100 national organized crime groups were “involved in the trade of illicit tobacco.” Aware of the sensitivities in connecting Canada’s native community with rampant illegal activity, Gagnon carefully repeats that tobacco smuggling “is not a First Nations issue, it is an organized crime issue.” But, he stresses, “This is not a reason not do to something about it.”

Despite ample concern regarding the health of Canadians who consume legal, heavily-regulated cigarettes, the federal government appears to have no interest in targeting illegal, unregulated tobacco dealers who flout health rules on underage sales, flavouring, packaging and all the other restrictions imposed on legitimate businesses. The same goes for the noisy lobbyists demanding even higher taxes and punitive lawsuits.

Why do native reserves known to harbour black market cigarette-manufacturing plants and which also have much higher rates of smoking than other parts of Canada experience none of the vociferous lobbying and complaining these groups direct towards legal, taxpaying tobacco manufacturers and their customers? Reconciliation should not condone law-breaking or poorer health outcomes.

If hypocrisy is not effective argument, Gagnon adds that allowing the illegal market to flourish in this way costs governments up to $3 billion per year in tobacco taxes. “It’s a lot of money,” he notes, hoping the prospect of all that extra tax revenue might someday spur the Liberals to action. Instead, they appear content to allow the black market in smokes to thrive unmolested.

Can’t Get Rich on their Own Supply

On the face of it, the legalization of cannabis should counter claims the Trudeau government is boosting the black market. One of the policy’s establishing concepts was that “legalizing, regulating and restricting access to cannabis…[would keep] profits out of the hands of criminals.” By making it a legal substance, the federal government claimed illicit cannabis sales would wither away, starving criminal organizations of the easy cash earned from drug sales. But doing so requires a healthy and profitable legal market. And after five years, federal cannabis policy appears to be doing more harm than good on this front.

George Smitherman is a former Ontario health minister and president of the Cannabis Council of Canada, which represents producers and processors in the nation’s legal cannabis industry. “It is a very, very challenging time,” Smitherman stresses in an interview. “Growers and retailers have invested collectively $45 billion in this industry and they have seen no return on their investment.” The years leading up to 2018’s legalization were marked by a “goldrush mentality,” he notes, with investors piling into the industry in hopes of quick and massive profits. It appears government regulators got carried away as well, introducing a panoply of taxes and regulations that are now driving the industry into the ground.

To begin, cannabis producers must pay a flat $1/gram federal excise tax on fresh or dried product. This fee was set when Ottawa figured cannabis would sell for $10/g. The retail price has since fallen as low as $3.50/g in some jurisdictions, meaning the effective tax rate has skyrocketed. Producers must also pay a special regulatory fee to Health Canada of $23,000 or 2.3 percent of gross revenues, whichever is larger. Given the slim margins of many operations, this fee alone can wipe out any profits. Plus there’s a host of provincial distribution markups and other sales taxes. “The government treats us like a cash cow,” Smitherman gripes, pointing out that taxes and fees comprise approximately 60 percent of the selling price of a $100 one-ounce package of dried marijuana.

The result of this unforgiving government-imposed fiscal environment has been a string of bankruptcies, shutdowns and layoffs throughout the cannabis industry in the past year. Normally such difficulties could be written off as the growing pains of an overbuilt industry going through an inevitable weeding out process. Curiously enough, however, the black market appears to be thriving.

While it’s impossible to estimate the size of any black market with precision, Smitherman cites reliable industry figures that put Canada’s legal and illegal cannabis sectors roughly in balance, with a 50/50 split. A federal update on cannabis legalization released last year puts the share of the illegal trade in marijuana in the mid-40-percent rate range. Whatever the true figure, the illicit market remains substantial five years after legalization.

In addition to accounting for perhaps half of all sales, the criminals are also the market’s price setters. Recall that in 2018, regulated weed sold for around $10/g while Statistics Canada’s StatsCannabis website reported a street price of less than $7/g. The current legal price of $3.50/g is the result of relentless competition from unregulated, illegal sellers. “The illicit market gets to play the game of ‘how low can you go’,” says Smitherman. “They face none of the regulations and pay none of the taxes that we do.” Illicit marijuana can often be bought on native reserves for as little as $1.40/g, he says. It would be impossible for legal sellers to meet such a price, given the federal excise tax and Health Canada regulatory fee.

The price problem for the legal industry is exacerbated by numerous regulations from all levels of government, similar to the health rules imposed on legal tobacco manufacturers. This includes everything from unwelcoming exterior design criteria for cannabis shops to content limits on the products themselves. The market for cannabis edibles – drug-infused candies or desserts – “has been conceded to the illegal trade in a significant way,” advises Smitherman. Tight restrictions on how much cannabis can be included in legal edible products have pushed discerning consumers into the arms of illegal providers.

Further evidence on the resiliency of the illegal market can be seen in Canada Border Services Agency statistics showing a dramatic increase in marijuana smuggling since legalization. In 2018, CBSA officers seized about 500 kg of illegal weed at Canadian points of entry. In 2020, that figure rose to 4,300 kg. Last year it hit 16,100 kg and shows no sign of abating. Last month, Niagara Falls border officers arrested an American citizen allegedly trying to smuggle 181 kg of unregulated cannabis and US$602,985 in cash into Canada.

Demand for high-interest, short-term loans has existed since the origins of money. It’s not going away simply because Ottawa declares such a thing to be ‘predatory.’

Rather than being disrupted by cannabis legalization, the illegal marijuana market continues to bustle. “Large volumes of cannabis products are controlled by criminal syndicates that are moving their product across our borders,” says Smitherman, adding it is “hardly shocking” to see such behaviour, given federal Liberal cannabis policy. The Trudeau government’s lax approach to the criminal justice system doesn’t help either. What should have been a great public policy triumph now lurches towards calamity as the legal market teeters on the verge of collapse.

Striking a Pose

Markets are stubborn things. Consumers and providers acting in their own perceived best interests create a form of economic democracy that brings supply and demand into balance at a particular price. And these forces are strongly resistant to crusading governments and their moral posturing, as the payday loan example demonstrates. The need for high-interest, short-term loans has existed since the origins of money. It’s not going away simply because Ottawa declares such a thing to be “predatory.” Rather, new government restrictions will encourage the supply of illegal, online loans from lenders who charge much higher interest rates and relentlessly harass their clientele. When confronted with evidence of the lawbreaking they have encouraged, the Liberal government shows no interest in punishing the real criminals.

The experience of black-market cigarettes is even more frustrating, given recent evidence clearly showing the best way to fight tobacco smuggling. Instead of lowering taxes to take profits away from criminal gangs – as has worked in the past – the Trudeau government imposes more rules, regulations and taxes on legal cigarette manufacturers with the intent of forcing them out of business. Then it changes the Criminal Code to go easy on tobacco smugglers. Finally, the botched legalization of cannabis shows how government policy meant to eliminate an illicit market has instead allowed it to thrive.

Always eager to strike a pose and ideologically opposed to the authority of market forces, the Trudeau Liberals habitually refuse to follow the consequences of their actions to their logical conclusions. The result is worse outcomes for legal businesses and their customers. And a boomtime for criminals.

Peter Shawn Taylor is senior features editor of C2C Journal. He lives in Waterloo, Ontario.

Source of main image: taberandrew, licensed under CC BY 2.0.