In their 2015 campaign for re-election, the Harper Conservatives proudly announced a no-deficit budget after years of working to rebalance spending and revenues following large stimulus deficits necessitated by the 2008 global economic crisis. Justin Trudeau’s Liberals, behind in the polls when the writ was dropped, proposed “modest” deficit spending totalling $25 billion in the first three years, returning to a balanced budget in the fourth. Although this was seen as a risky strategy, the Liberals were rewarded with a decisive majority.

That $25 billion promise has ballooned to nearly $70 billion in actual deficits over four years. And Trudeau’s promise of a balanced budget has been replaced by a planned total of $94 billion in federal deficits over the next four years. The NDP and Green election platforms proposed even higher spending. Despite these campaigns featuring such a staggering accretion of our national debt, pollsters found that deficit spending didn’t rank as a major election concern for most Canadians.

This also occurred despite the clear and responsible alternative offered by the Conservatives under Andrew Scheer. Striving to balance political reality against the dangers of driving the country ever-deeper into debt, they proposed a $25 billion deficit in the first year along with moderate fiscal tightening that would move Ottawa to a balanced budget in five years. The election results confirm that most Canadians have lost all fear of deficit spending, no matter how large.

Most economists believe that governments should constrain spending in good times to preserve financial capacity for stimulus spending during recessions. According to this recent report, Canadian economic growth is forecast to be 1.5 percent this year and 1.6 percent in 2020. That’s not great, but it’s still not in stimulus territory. Scheer’s plan to cut back gently was the correct one.

But instead of controlling spending during a robust economic period in Canada, the Liberals ran huge deficits in their first term and now, as a minority government, are planning to greatly increase deficit spending in their second. That leaves no financial room for a recession. Since the last recession was in 2009, for the Liberal plan to work would require at least 15 years without a recession, a most unlikely prospect

What would motivate the Liberals to risk putting Canadians in such economic peril? The answer is that government spending is being used to offset a dramatic loss of private-sector confidence. This November 2018 Fraser Institute report stated: “The federal government’s introduction of higher taxes, mounting debt and increased regulation has left Canada a much less attractive place to invest.” The results have been ominous, to say the least. “Crucially, Canadians have increasingly looked to other countries to invest, with the amount Canadians invest abroad rising 74 percent from 2013 to 2017,” the report warned. “At the same time…investment from other countries into Canada dropped a staggering 55.1 percent.” What this signifies is tens of billions of dollars in capital investments and tens of thousands of well-paying jobs – all of it now occurring in other countries.

Other credible economic organizations have similarly worrying findings. The World Bank’s most recent “Ease of Doing Business” analysis has Canada dropping from fourth place in 2006 to 22nd in 2019. That is four spots lower than Australia – and only three better than Azerbaijan! And a majority of respondents to a Business Council of Canada survey listed Canada’s “uncertainty and lack of predictability in regulatory processes” as negatives for investors. That was before last month’s election. The prospect of a profligate Liberal minority government dependent on the even-more financially destructive policy positions of the NDP or Bloc Québécois is enough to send still more investors scurrying to the exits or avoiding Canada to begin with.

Canada’s economy has become dependent on ever-bigger government spending while the policies of its federal government actively discourage private-sector investment. As Italians know all too well, this game ends when deficits can no longer be financed, pushing the country over a financial cliff.

That high-level economic signals like economic growth have remained strong while private-sector investment and job creation have been shrinking can only be explained by those tens of billions of deficit dollars. Canada’s economy has become dependent on ever-bigger government spending while the policies of its federal government actively discourage private-sector investment (and those policies continue to worsen). As Italians know all too well, this game ends when deficits can no longer be financed, pushing the country over a financial cliff.

Canada has stood on that cliff before in the disastrous legacy of Justin Trudeau’s father. During the 15 years Pierre Trudeau was prime minister, federal spending rose from 30 percent to 53 percent of GDP. Immense public spending overheated the economy, resulting in runaway inflation. By 1981, Canada’s prime lending rate reached an incredible 22 percent. The inability to meet skyrocketing interest costs induced widespread corporate and personal bankruptcies. Escalating mortgage rates caused many Canadians to lose their homes. With government bonds yielding 19 percent, accessing business risk capital was virtually impossible.

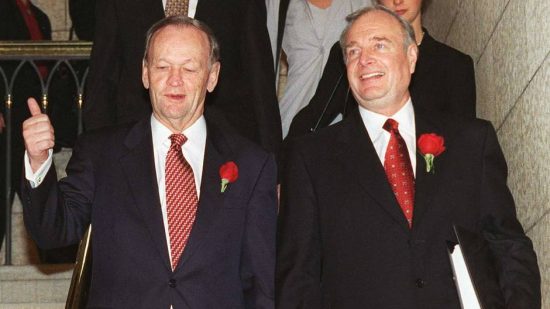

By the time Trudeau-the-elder retired in 1984, Canada’s national debt had grown by 700 percent and the country’s international debt ratings had collapsed. We were transformed from one of the world’s financially strongest countries into an economic basket case. It would be two decades before tough fiscal discipline overcame compounding interest payments and began to reduce the country’s real-dollar debt. Some of that hard work was done by Progressive Conservative prime minister Brian Mulroney, but much of it was delivered by the unlikely (and initially reluctant) duo of prime minister Jean Chretien and his finance minister, Paul Martin. Their record proves that being a Liberal doesn’t require you to be a fiscal wrecking ball; it’s a choice.

The current annual cost of servicing Canada’s trillion-dollar “market debt” (borrowed funds subject to interest payments) is $26 billion. But as Canada’s debt keeps rising, so will the interest rate investors require to fund it. The $94 billion in Liberal deficit spending that’s planned over the next four years, together with even a modest interest rate increase of 2 percent, would take the annual interest cost to more than $50 billion at the end of four years. Canada would be headed back to where it was 40 years previously – and with similarly ruinous policies to drag it down further.

Just as the generation of taxpayers that came after Pierre’s reign ended had to pay for his profligacy, the next generation of taxpayers will bear the burden of paying down Justin’s debt. So why do most young Canadians vote for parties promising increased deficits? As public policy analyst and author Mark Milke noted in a recent media interview, “Every generation has to learn about the consequences of excessive borrowing for themselves.”

Building an immense national debt is like taking out a huge mortgage, then leaving it for your children to pay back. But not only will today’s young voters have to pay down Canada’s massive mortgage, they will also foot the mounting cost of caring for the aging people who allowed it to happen. Most young voters are oblivious to this reality. They are in for a set of tectonic shocks.

The $94 billion in Liberal deficit spending, together with even a modest interest rate increase of 2 percent, would take the annual interest cost to more than $50 billion. Canada would be headed back to where it was 40 years previously – and with similarly ruinous policies to drag it down further.

Thankfully, there is a group of young people working to educate them. They call themselves “Generation Screwed.” Kris Rondolo, 29, the group’s executive director, warns that, “Over-spending equals debt, and debt is an unfair tax on Canada’s younger generations and those not yet born.” The Generation Screwed website includes a rolling debt clock showing that Canada’s national debt currently amounts to $18,700 for every man, woman and child and is growing by more than $54 million a day.

A “How screwed are you?” link lets you add your share of provincial debt to the national debt. Ontarians are the most screwed, owing $43,200 each. Quebecers come next at $40,700, followed closely by Manitobans. Albertans, who spent the 90s scraping their way out of debt, making their province debt-free in 2004, now owe $34,400 each (of which a total of nearly $70 billion is provincial debt alone). That’s a little more than British Columbians. And now the debt clock will be going into hyperdrive for the next four years.

Gwyn Morgan is the retired founding CEO of Encana Corp.