He burst onto the centre of Canada’s political stage just months ago, quickly seized the national conversation and presided over perhaps the greatest political turnaround in Canadian history. Yet Prime Minister Mark Carney remains largely an enigma. Despite spending a long career as a banker and financier, he also chose to author a book – Value(s): Building a Better World for All – in which he critiqued modern capitalism, called for a more “human” set of values, and portrayed climate change as an existential threat that demanded global “decarbonization” through international collaboration, nation-level central planning and taxation of emissions sources. As earlier noted in C2C, Carney was also the UN’s Special Envoy for Climate Action and Finance and chaired the Global Financial Alliance for Net Zero which, bluntly stated, was aimed at killing off investments in fossil fuel projects.

Upon winning Canada’s April 28 election, however, Carney took several steps that symbolically or materially distanced him from the ideological approach of his predecessor, Justin Trudeau. After declaring this a “critical time” in Canada’s history, Carney’s mandate letter to his newly appointed ministers was brief and business-like, focused on reviving Canada’s economic growth, emphasizing the need to act quickly. His immediate legislative priorities, reflected in Bill C-5, An Act To Enact The Free Trade And Labour Mobility In Canada Act (aka the One Canadian Economy law), and his recent meeting with Canada’s premiers have focused on breaking down internal trade barriers and launching large industrial and infrastructure projects from coast to coast.

Yet even in such key areas, Carney’s public statements are often hedged and shrouded in ambiguity. After the One Canadian Economy bill was tabled less than two weeks ago, Carney said he would only support a new export energy pipeline if absolutely everyone else agreed first. “We must have a consensus of all the provinces and the Indigenous people,” he told reporters, speaking in French. “If a province doesn’t want it, it’s impossible. It’s not the choice of the federal government.” Carney is also said to be under pressure from Trudeau-era ideologues in his new Cabinet who are not only against new oil and natural gas development but want to roll back and phase out this whole industry – the nation’s number-one source of export earnings. His government was notably absent from Calgary’s recent Global Energy Show, a vast event that attracted leaders and officials from around the world.

The hedging and ambiguity will need to come to an end, and soon. Carney did become prime minister at a crucial time. Canada’s trends in productivity and living standards are among the worst of the advanced economies. Under Trudeau, the federal government’s annual budget deficits grew steadily and doubled the Canadian national debt. Current energy policies are sharply increasing the costs of all energy sources; the public’s opposition to carbon taxes is clear. Federal policies and regulations have prompted the cancellation of energy production and transportation projects worth over half-a-trillion dollars during the past decade.

In summary: Canadians in their wisdom have elected as Prime Minister a man about whom relatively little is known, to lead a Liberal Party about which quite a lot is known. Even now, no-one knows for sure how the Prime Minister will respond to the multiple and mounting pressures. But Carney is fast approaching a decisive fork in the road.

Given his party’s past performance and his oft-expressed views on climate change, Carney might choose to “stay the Liberal course”, extending every economic and political-economic problem afflicting Canada over the past decade into the next one. Alternatively, he could surprise nearly everyone by metamorphosing into a “new” Carney, one who acts with common sense and governs with pragmatism, responding to threats and opportunities as they arise based on an assessment of risks, costs and benefits.

Below are the key economic policy questions Carney must confront, the difficult choices he will need to make – and the radically different outcomes based on whether he decides to dress up in a leftover “stay the Liberal course” costume or put on a new “sensible-flexible” business suit.

The Federal Budget

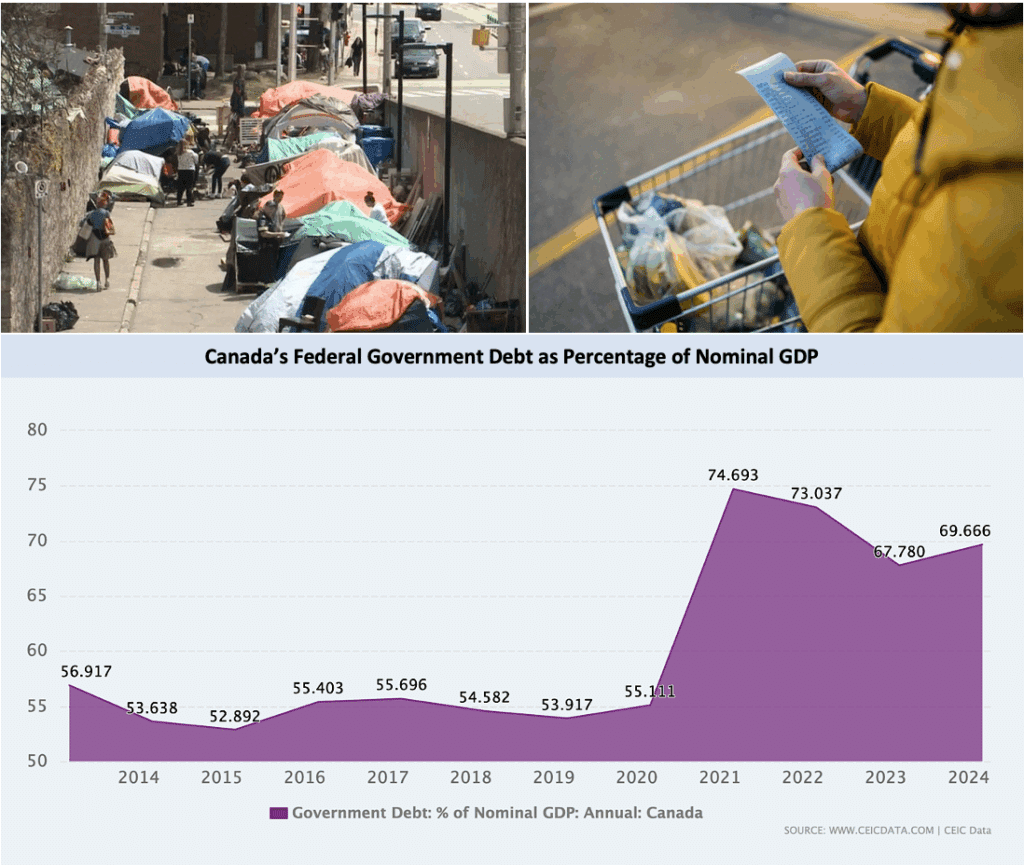

Staying the Liberal Course – Canada’s accumulated federal debt now approaches $1.3 trillion. The Liberal Party’s 2025 election platform, “Canada Strong”, proposed to increase government outlays by $130 billion over the levels projected by the Trudeau government in its 2024 Fall Economic Update, and to increase the federal debt by about $225 billion – $100 billion more than Trudeau was planning to borrow over the same period. The Carney government’s budgetary plan is thus even worse than merely staying the dangerous course Trudeau steered, amounting to accelerating the ship of state onto the reefs.

In March, the Parliamentary Budget Officer projected that the fiscal 2026 federal deficit would be $42 billion. With every new spending announcement by Carney, Canada faces the prospect of by far the highest deficit in its history.

Sensible-Flexible Approach – Interest charges on the Canadian national debt already cost taxpayers more than $1 billion per week. Carney would thus find it extremely difficult to implement all of “Canada Strong’s” more than 100 envisioned new spending measures even if he really wanted to. The financial pressures themselves thus provide a rationale to become more selective.

Carney also could borrow a page from former Prime Minister Jean Chretien’s approach in 1995. Facing excruciating financial pressure – including reports out of New York that the International Monetary Fund was preparing to intervene in Canada’s financial management – Chretien and his able Finance Minister, Paul Martin, instituted a government-wide review of all programs, requiring departments to provide scenarios to cut expenditures by 10 percent, 20 percent and 30 percent. Chretien and Martin were able to reduce spending by almost 22 percent over the next four years.

An additional factor adds to the urgency of clarifying the current government’s plans. Carney recently announced that Canada’s defence spending would be increased sufficiently this year to meet the NATO policy of 2 percent of GDP. Doing so will add $9.3 billion to the $35 billion in new current-year spending announced in “Canada Strong”. Meanwhile, the platform’s assumption that Ottawa will receive $20 billion from tariffs on U.S. imports appears unlikely. In March, the Parliamentary Budget Officer projected that the fiscal 2026 federal deficit would be $42 billion. With every new spending announcement, Canada faces the prospect of by far the highest deficit in its history – all without even a budget for Parliament to review. The pressure upon Carney to do better will only increase.

How does the Liberal government’s fiscal plan affect the Canadian national debt?

Mark Carney and his Liberal government’s current fiscal plan would worsen the Canadian national debt (federal debt, not including debt incurred by provinces or municipalities) by increasing federal spending by $130 billion more than the increases previously planned by the Justin Trudeau government, and borrowing $100 billion more than previously foreseen. With accumulated federal debt already nearing $1.3 trillion and no formal budget released, Canada this year faces the prospect of by far the highest federal budget deficit in its history.

Carbon Taxes

Staying the Liberal Course – After reducing to zero as of April 1 the carbon tax end-users like households and small businesses pay on products like motor fuels and natural gas heating, the Carney government made no change to the carbon tax increases or related fuel taxes imposed on “large emitters”. This “industrial” carbon tax now stands at $95 per tonne of carbon dioxide equivalent emissions and is scheduled to increase to $170 per tonne by 2030.

Where they can, industries will pass these higher costs on to their business customers, and these will raise prices on the goods they sell to consumers. Exporters are unlikely to be able to do this, however, so such producers will lose sales, become unprofitable and/or move their operations to more tax-friendly countries, thus reducing Canadian employment, investment incomes and government tax revenues.

Sensible-Flexible Approach – Carney could transition the carbon pricing regime away from taxes to a “cap and trade” pseudo-market system similar to the one that Quebec shares with California. The rates or “cost of carbon” in such a regime would be determined more by supply and demand conditions, and businesses could more realistically seek efficiencies and the best available deal, thus (theoretically at least) limiting the economic damage.

Alternatively, Carney could simply freeze the industrial carbon tax at current levels or even reduce the rate. Either approach would offer political benefits as the industrial carbon tax is a major irritant in several provinces, notably Saskatchewan and Alberta. Alberta in March froze its industrial carbon tax at $95 per tonne while Saskatchewan went one step further and suspended its tax altogether, practically daring Ottawa to a challenge.

Carbon Border Adjustment Mechanism (CBAM)

Staying the Liberal Course – Carney has pledged to accelerate the introduction into Canada of the CBAM concept, essentially a fee that foreign-based companies would have to pay on goods they wished to sell in Canada. The European Union version is charged on imports from countries that do not impose carbon taxes at least as high as the EU’s. A CBAM resembles a tariff, but with more bureaucracy.

Sensible-Flexible Approach – Because a Canadian CBAM would be viewed by U.S. President Donald Trump and his negotiators as a significant non-tariff barrier or tariff-by-another-name, it would surely worsen the already-complicated and potentially ruinous Canada-U.S. trade dispute – while needlessly expanding that dispute to all countries that do not follow similarly onerous climate policies. This would weaken the odds of striking new bilateral trade agreements, thus thwarting another Carney policy, namely reducing Canada’s dependence on the U.S. market. Instead, as part of a negotiated agreement with the U.S. to remove or reduce trade barriers, Carney could forego any CBAM.

Clean Electricity Standard

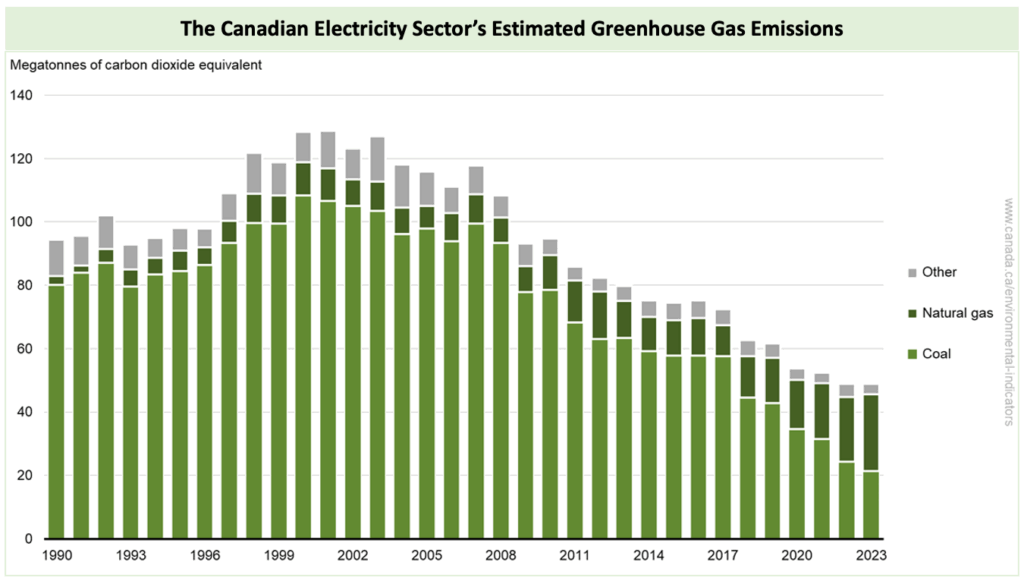

Staying the Liberal Course – The federal Clean Electricity Standard requires that all power generation based on hydrocarbons (oil, natural gas and coal) cease no later than 2035. In its modelling of the regulation’s effects, Environment and Climate Change Canada projected net costs of $58 billion, of which $35 billion would be borne by Alberta. An exclusive analysis by C2C’s Jim Mason, a retired nuclear physicist who specialized in statistics, concluded that the actual costs of achieving a “net zero” electricity grid would be several times higher and, equally important, that Canada lacks the political will or the regulatory, engineering, financial or construction capacities to achieve the changeover even by Ottawa’s recently revised target of 2050.

Sensible-Flexible Approach – Canada’s GHG emissions from electricity generation decreased from 125 million tonnes (MT) of carbon dioxide equivalent in 2005 to 49 MT in 2022, an impressive decline of 61 percent that was achieved relatively smoothly, albeit at the cost of higher electricity rates. Today only Alberta, Saskatchewan and Nova Scotia still produce significant greenhouse gas emissions from electricity generation, but have warned that a forced transition would not only impose ruinous costs but undermine their grids’ stability and reliability, i.e., threaten widespread power blackouts. The simplest move for the Carney government would be to push out the deadline for complete decarbonization until 2060 or 2075 while allowing up to 20 percent of power generation to remain hydrocarbon-based to reduce the risks of brownouts and blackouts.

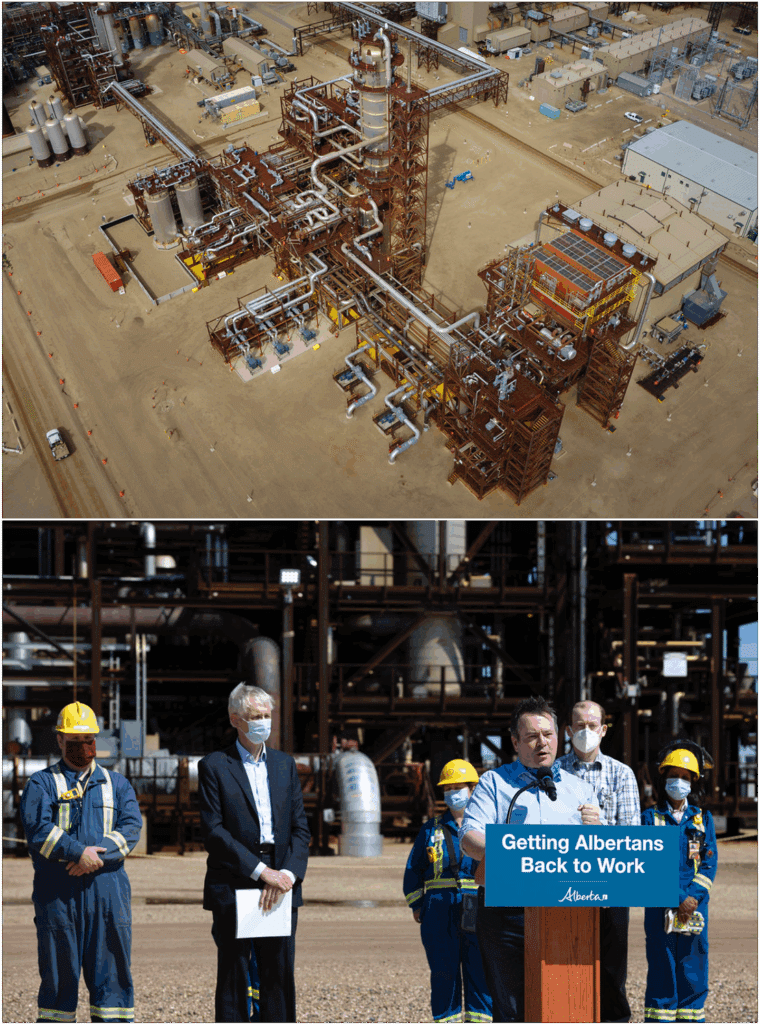

Emissions Cap on Oil and Natural Gas Production

Staying the Liberal Course – By year-end the government intends to implement regulations under the Canadian Environmental Protection Act to impose a maximum level or “cap” on greenhouse gas emissions from the oil and natural gas sector, thus formalizing a policy announced by Trudeau in 2024. The cap is intended to force industry emission reductions of a further 42 percent by 2030. Although the federal government denies it, the oil-producing provinces insist that this amounts to a cap on production, making it possibly the Liberal government’s single-most objectionable policy. It has unquestionably been a factor in the rise of Alberta separatist sentiment, and its removal is among the foremost of Premier Danielle Smith’s “nine demands” for policy changes.

Carney could cut his government’s emission reduction goal to 30 percent and extend the deadline to at least 2035. He also could reduce industry compliance costs by providing tax incentives. It is difficult to foresee such half-measures satisfying the Alberta and Saskatchewan governments, however.

A January 2024 report by the Conference Board of Canada projected that a mid-range scenario (involving cuts to methane emissions of 60 percent plus various efficiency investments) would not achieve the federal government’s reduction goals, thus requiring outright cuts to oil and natural gas production. Canada’s GDP would fall by 0.9 percent – over $30 billion – federal and provincial government revenues would be reduced by $9.9 billion and the profits of oil and natural gas producers would decline by $2.3 billion. Alberta would be disproportionately hit, suffering a GDP decline of 3.8-6.7 percent.

Sensible-Flexible Approach – As a partial concession (or opening negotiating position), Carney could cut his government’s emission reduction goal to 30 percent and extend the deadline to at least 2035. He also could reduce compliance costs by providing the tax incentives industry seeks for carbon capture and storage projects, which reduce net emissions. It is difficult to foresee such half-measures satisfying the Alberta and Saskatchewan governments, however, so this could prove possibly the most contentious policy area Carney faces.

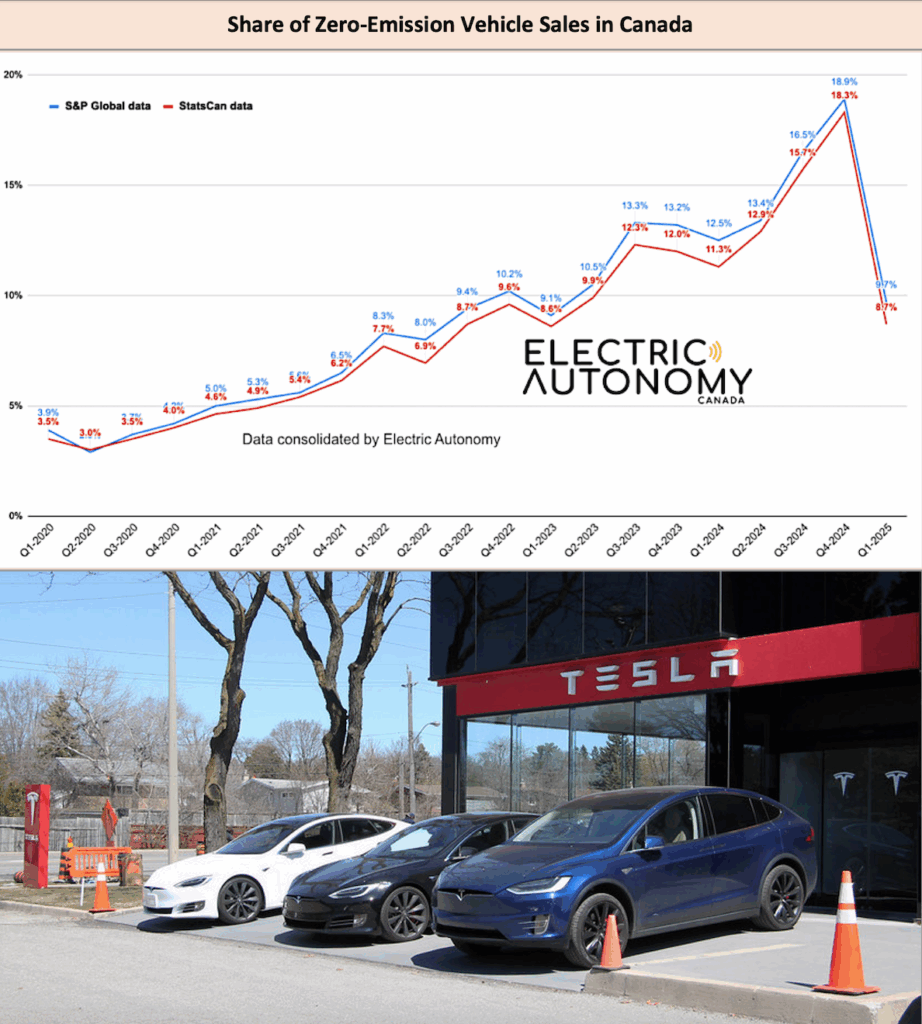

Electric Vehicle (EV) Sales Target

Staying the Liberal Course – Federal rules require that 20 percent of light-duty new vehicles sold next year be zero-emissions, and this percentage will rise every year until no new internal-combustion-engined vehicles can be sold in 2035. Trudeau stuck to this timetable despite mounting political pushback and severe problems in developing Ontario’s EV and battery manufacturing sector, and Carney has given no indication that he’s considering changing course. Just last week the Liberals, backed by the Bloc Québécois, NDP and Greens, voted to reaffirm the EV “Availability Standard”, i.e., the 2035 gas-powered car ban.

Sensible-Flexible Approach – Federal EV purchase incentives have been suspended, consumers are not buying EVs at close to the steeply accelerating rates required to meet the target – in fact, Canadian EV sales are basically collapsing – vehicle manufacturers are losing tens of thousands of dollars on every EV sale, and public opinion has swung against the 2035 deadline. In the U.S., the Trump Administration plans to eliminate EV sales targets at the federal level and force their elimination at the state level. For the good of Ontario’s export-dependent manufacturing sector as well as all Canadian motorists, Carney could choose to align Canada’s vehicle emissions standards and sales targets with those in the U.S.

Net-Zero Building Code

Staying the Liberal Course – Even though building codes are constitutionally a provincial jurisdiction, the federal government plans to impose strict building codes that aim to reduce energy consumption in new residential buildings by 65 percent and in new commercial buildings by 59 percent from 2019 levels by 2030. The Fraser Institute estimates this would increase typical residential construction costs by 8.3 percent by 2030, adding up to $55,000 to the average cost of a new single-family house.

Sensible-Flexible Approach – Given Canada’s ongoing and thus far intractable housing affordability crisis, new building codes that dramatically raise costs in service to an ideological goal could not come at a worse time. As a face-saving compromise that falls short of abandoning this policy, Carney could modify the planned changes based on advice from the Canadian Home Builders Association as to what is technically and economically feasible and cost-effective.

What are the economic risks of the planned carbon tax increase on large Canadian industries?

The planned carbon tax increase on large emitters – going from $95 per metric tonne in 2025 to $170 per tonne by 2030 – poses serious risk to the Canadian economy. Where they can, industries will pass these higher costs on to their business customers, and these will raise prices on the goods they sell to consumers. Exporters, however, are unlikely to be able to do so, and will lose sales, see profits decline and possibly consider relocating operations – reducing Canadian employment, investment incomes and government tax revenues.

Impediments to New Oil and Natural Gas Infrastructure

Staying the Liberal Course – The current federal permitting regime for new oil and natural gas pipelines imposes onerous and time-consuming requirements on proponents. This includes the Impact Assessment Act’s (IAA) requirement that project sponsors satisfy the Minister of Environment and Climate Change that the project will not undermine attaining the government’s 2050 net-zero target. There is also a moratorium on oil tankers docking along the northern B.C. coastline.

Carney has said he favours establishing pre-approved energy corridors to facilitate “clean energy projects of national interest jointly identified by the federal and provincial governments and Indigenous peoples.” His specific reference to “clean energy” could signal that he wants to focus mostly on long-distance electricity transmission lines to transport power from areas with surplus renewable energy-based generation, in order to displace/replace hydrocarbon-fired generation in other regions.

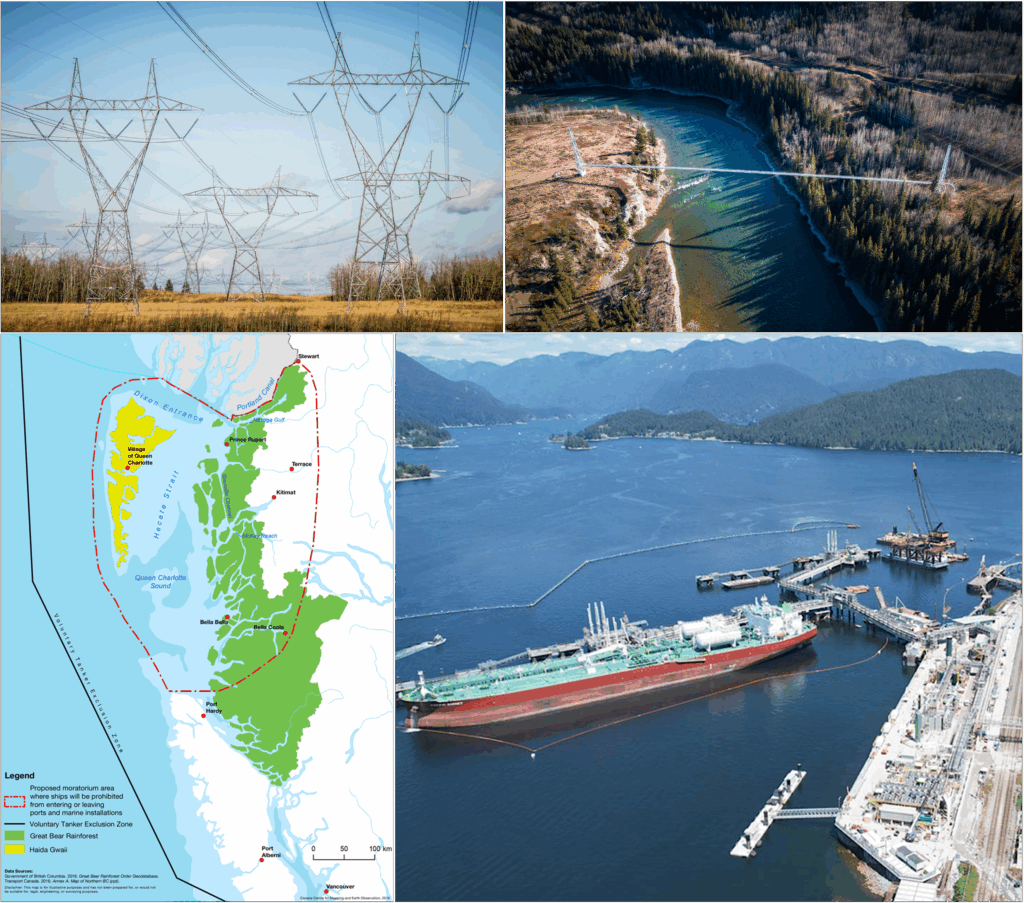

Hedging and ambiguity: By saying he favours “clean energy projects of national interest”, Carney could slyly mean long-distance electricity transmission lines (top left) rather than new oil and natural gas pipelines (top right). Carney has so far refused to amend the unconstitutional Trudeau-era Impact Assessment Act, nor lifted Trudeau’s moratorium on oil tankers docking along B.C.’s north coast. At bottom right, the expanded Trans Mountain oil export terminal on B.C.’s south coast in Burnaby, B.C. (Sources: (top left photo) Kurayba, licensed under CC BY-SA 2.0; (top right photo) Shutterstock; (map) Government of Canada; (bottom right photo) Trans Mountain)

Hedging and ambiguity: By saying he favours “clean energy projects of national interest”, Carney could slyly mean long-distance electricity transmission lines (top left) rather than new oil and natural gas pipelines (top right). Carney has so far refused to amend the unconstitutional Trudeau-era Impact Assessment Act, nor lifted Trudeau’s moratorium on oil tankers docking along B.C.’s north coast. At bottom right, the expanded Trans Mountain oil export terminal on B.C.’s south coast in Burnaby, B.C. (Sources: (top left photo) Kurayba, licensed under CC BY-SA 2.0; (top right photo) Shutterstock; (map) Government of Canada; (bottom right photo) Trans Mountain)In addition, Carney has said he won’t repeal or even further amend the IAA even though the Supreme Court of Canada has ruled the law largely unconstitutional and the Government of Alberta is preparing to challenge the Trudeau government’s token amendments to the original law. Nor will Carney eliminate the requirement that projects not prejudice the attainment of net-zero, or end the aforementioned tanker ban, which renders an oil pipeline from Alberta to Prince Rupert moot.

Some have even attempted to portray the UNDRIP consent requirement as Indigenous authority to veto any project on or near recognized or claimed Indigenous lands. Acceptance of such a view by the Carney government would go beyond merely “staying the Liberal course” and could spell ruin for his stated economic agenda.

Sensible-Flexible Approach – Using the impending court battle as a face-saving reason, Carney could substantively amend the IAA to allow greenhouse gas emissions to be considered as only one factor rather than determinative in deciding whether a proposed project is in the national interest. He also could set a timetable for lifting the moratorium on northern West Coast tanker traffic after a thorough independent safety and environmental assessment.

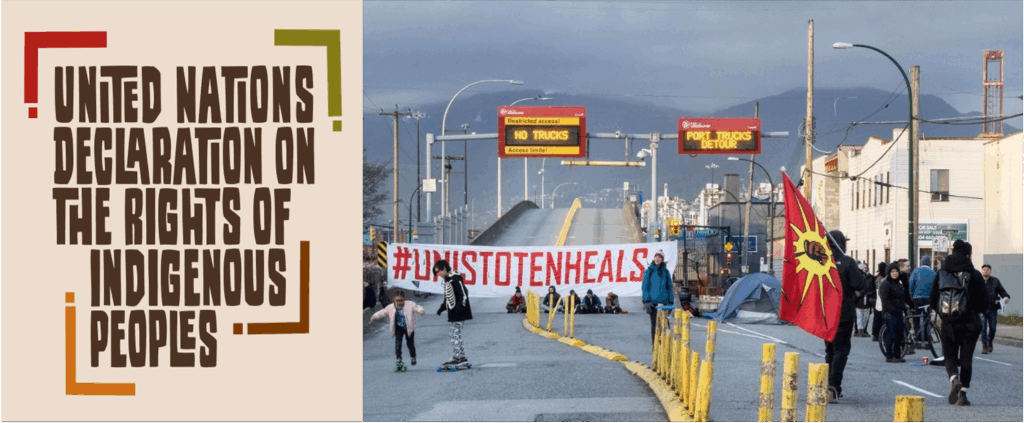

UNDRIP Action Plan

Staying the Liberal Course – The Liberal government made the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP) the law of the land via federal legislation of the same name, which passed in 2021, followed in 2023 by an Action Plan for implementation. UNDRIP requires that in certain circumstances governments engage in good-faith consultation and cooperation, leading to informed consent, prior to approving a project that affects Indigenous lands or treaty rights.

Recent Liberal policy has tended towards an expansive view of the “consent” requirement. Some have even attempted to portray this as Indigenous authority to veto any project on or near recognized or claimed Indigenous lands, claims that were recently repeated by Indigenous leaders. Acceptance of such a view by the Carney government would go beyond merely “staying the Liberal course” and could spell ruin for his stated economic agenda.

The Supreme Court of Canada has repeatedly found that the United Nations Declaration on the Rights of Indigenous Peoples does not give any First Nation a veto right over major projects in Canada. At right, protesters block entrance to the Port of Vancouver in support of the Wet’suwet’en trying to halt construction of a natural gas pipeline in northern B.C., 2020. (Source of photo: Sally T. Buck, licensed under CC BY-NC-ND 2.0)

The Supreme Court of Canada has repeatedly found that the United Nations Declaration on the Rights of Indigenous Peoples does not give any First Nation a veto right over major projects in Canada. At right, protesters block entrance to the Port of Vancouver in support of the Wet’suwet’en trying to halt construction of a natural gas pipeline in northern B.C., 2020. (Source of photo: Sally T. Buck, licensed under CC BY-NC-ND 2.0)Sensible-Flexible Approach – Canada has more than 600 First Nations along with unresolved land claims and other disputes extending over broad areas of the country. The Supreme Court of Canada has repeatedly ruled that nothing in the Canadian Constitution gives any First Nation a veto right over a major project decision by the Government of Canada. Retired litigation lawyer Andrew Roman also has argued that UNDRIP does not give Canadian Indigenous peoples such a power. Carney thus has ample constitutional, judicial and legal grounds to reject claims of veto rights while reaffirming his government’s commitment to the principles of reconciliation and enhancing the economic participation of Indigenous people and communities in natural resource development.

The Scope of Efforts to Achieve Net-Zero

Staying the Course – The federal government has implemented over 140 measures to reduce greenhouse gas emissions, using the complete range of policy instruments including taxes, subsidies, regulations, codes, mandates and procurement policies. Provincial and territorial governments have implemented over 300 more climate measures. In “Canada Strong”, Carney committed his party to adding several more, notably including financing a cross-Canada electricity transmission system (an incredibly expensive as well as technically dubious proposition), as well as mandating that companies prepare climate disclosures and transition plans, and creating a so-called “Carbon and Nature-based Emissions” trading market.

Sensible-Flexible Approach – The multitude of diverse though often overlapping federal, provincial and even municipal measures makes it virtually impossible to assess the marginal impact or cost-effectiveness of any single measure, and confuses the public. Carney has said he views accelerating the rate of technological innovation to be the best and most economically efficient way to encourage energy transitions, and has acknowledged that an increased focus on adapting to climate changes and building resilience would be wise. He could put those views into practice by reducing and streamlining the number of greenhouse gas-related measures, coordinating better with the provinces and territories, and reducing the tendency of federal policy to “pick technology winners.”

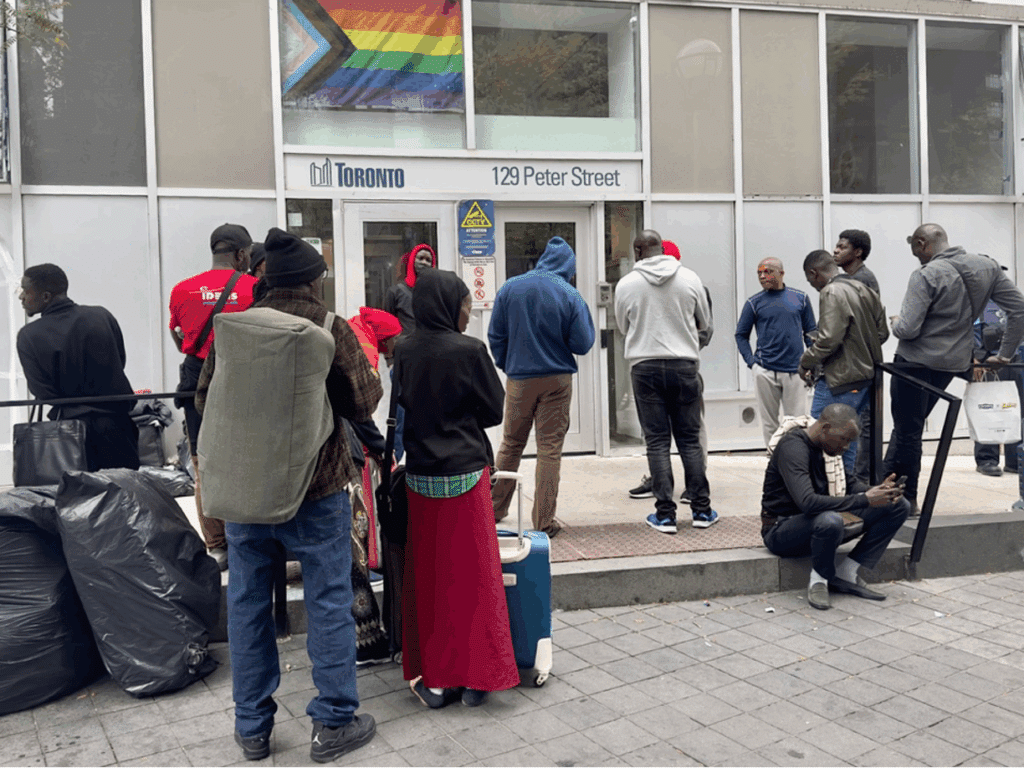

Immigration Levels

Staying the Course – A major reason why housing in Canada is increasingly unaffordable is the unprecedented rise in population due to immigration, as discussed in more detail in this recent C2C article. “Canada Strong” indicates the Liberal government plans to “adjust” the levels of new permanent and temporary residents, starting with short-term targets below 400,000 per year, and with a view to stabilizing permanent admissions at less than 1 percent of Canada’s population annually beyond 2027. This will still be double the immigration rate prevailing in the pre-Justin Trudeau era. In addition, intake numbers for temporary foreign workers and international students (many of whom then apply for permanent residency) are also much higher than in the past.

Sensible-Flexible Approach – According to the Canada Mortgage and Housing Corporation, restoring housing affordability to 2004 levels requires building approximately 3.5 million additional housing units by 2030. The Liberals’ immigration plans make attaining this unlikely. If he is serious about mitigating Canada’s housing crisis – as well as other economic and social problems associated with record-level immigration – Carney should move decisively to reduce permanent immigration to near or below pre-Trudeau government levels of about 200,000 per year, equivalent to approximately 0.5 percent of Canada’s current population, while also sharply curtailing “temporary” categories like foreign workers and students.

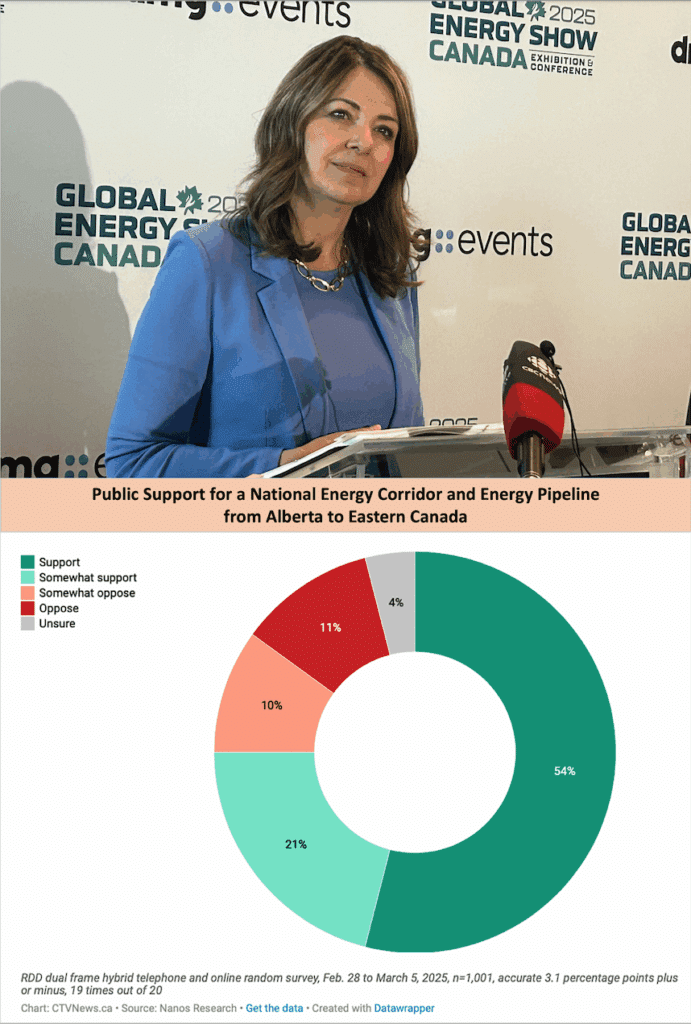

How has public support for oil and natural gas changed in light of challenges facing the Canadian economy?

Time: A Luxury Neither Carney nor Canada Can Afford

Pressure is growing upon Carney to make some real decisions – including from Opposition Leader Pierre Poilievre, who recently pointed out that our economic woes demand not incremental steps but “giant leaps”. And public opinion has shifted decisively in favour of robust economic development – including new fossil-fuel-related projects, with one poll showing 75 percent nationwide support for a new cross-country oil pipeline. That strengthens the hand of energy-producing provinces, particularly Alberta and Saskatchewan which, furious about the adverse effects of federal climate policies, are contemplating plebiscites on seceding from Canada.

Alberta’s Premier has drawn up a list of “nine bad laws” for Carney to repeal or amend. In a recent video interview, Smith proposed a “grand bargain” that would include investing heavily in oil and natural gas emissions reduction technology in return for rapid federal approval of new pipelines. Canada’s premiers, she noted, have put forward some 90 projects to place on Carney’s “national project list” for fast-track approval; the test will come when Alberta adds a major oil or natural gas pipeline. “I’m prepared to walk the path with him, but we’ll know pretty soon,” Smith said. “We’re either going to be Team Canada or we aren’t. And Team Canada doesn’t mean everybody gets their product to market except Alberta.” On a promising note, the two governments recently announced they have each appointed Cabinet-level negotiating teams to begin discussing large energy projects.

Amidst all of this, however, the U.S. economic threat continues to loom. The Trump Administration is aggressively pursuing an “America First” trade policy, imposing punitive-level tariffs on Canadian industries and still musing about making Canada the “51st state” as though this were an appropriate punishment for behaving badly. Carney and Trump did initiate bilateral trade talks at the recent G7 meeting in Alberta (where, incidentally, climate change was not even explicitly on the agenda). But the two trading nations’ economic relationship is vast and intricate; despite recent talk of doing a deal within 30 days, no-one can say how long negotiations will really take, how much further uncertainty will be generated, how many new tariffs or other punitive measures might flare up along the way, or what the ultimate outcome will be.

Understanding who Carney, the international man of mystery, really is might normally require several years of uncertainty before Canadians knew for sure. The country’s current circumstances do not provide the luxury of several years’ uncertainty.

Even if the trade dispute is amicably and promptly resolved, Canada still faces an equally profound issue: the yawning gap between the two countries in productivity, per capita income and economic growth. Individual Americans, on average, now earn at least 50 percent more than Canadians – and Canada is still slipping. Contrary to innumerable predictions of a “Trump Depression”, the U.S. economy is actually buoyant, posting first quarter annualized GDP growth of 4.5 percent, job creation on the order of 150,000 net new jobs per month – even as tens of thousands of public-sector workers are let go – low inflation of just 2.4 percent and sharply rising per capita income. This increases the urgency for Canada to arrest its economic decline and resume growth – ideally at a higher rate than the U.S., so that we can begin to close the enormous economic gap.

If Mark Carney is an enigma, Donald Trump is even more so – even if a bombastic and performative one. While domestic dissent and opposition – especially from Alberta – will be an important driver in several key areas, American policy decisions may prove the single most important factor constraining Carney’s choices.

For Carney, the difference between staying the Liberal course and being flexible is only partly a choice between ideology and pragmatism. It also may be the choice between maintaining some degree of fiscal restraint and bursting the federal Treasury. Understanding who Carney, the international man of mystery, really is might normally require several years of uncertainty before Canadians knew for sure. The country’s current circumstances do not provide the luxury of several years’ uncertainty, however; for the good of Canada and his own success as prime minister, Carney needs to take clear positions and he needs to act – now.

Robert Lyman is a retired energy economist who served for 25 years as a policy advisor and manager on energy, environment and transportation policy in the Government of Canada.