If you love a firm, chewy Montreal-style bagel, then you ought to know about St-Viateur Bagel, the city’s oldest and arguably most-famous bakery. “We’ve been around for 68 years,” boasts Vince Morena, co-owner with his father and two brothers of the bustling business in Montreal’s colourful Mile End neighbourhood. “This is an artisanal product – hand-made and baked in a wood-fired oven. I started here when I was 14, my dad started when he was 14.”

Morena’s flagship bagel shop is a well-known destination for foodies, celebrities and international tourists. And to meet demand, it’s open 6:00 am to midnight, seven days a week. Once inside, however, there’s only one way for all those hungry customers to get their hands on a tasty wood-fired St-Viateur bagel. “This is our original store,” Morena says with pride, “and it is cash only.”

Whatever he may think about his bagels, Prime Minister Mark Carney wants to permanently change how Morena runs his business – and how millions of Canadians buy things every day. Earlier this year the Liberal government introduced Bill C-2, known as the Strong Borders Bill. This sprawling and controversial legislation includes measures to tighten security along the Canada-U.S. border as well as significant amendments to laws regarding immigration, illegal drugs, financial crime and government surveillance.

And buried deep within these changes is a provision of great consequence to St-Viateur Bagel and numerous other businesses across the country. An amendment to Canada’s existing anti-money laundering rules would prohibit any person, business, bank or charity from accepting “a cash payment, donation or deposit of $10,000 or more in a single transaction or in a prescribed series of related transactions that total $10,000 or more.” If passed, it would become illegal for anyone to transact any business over $10,000 using paper money.

Such a move is an insult to his life’s work, Morena says in an interview. “If we do $20,000 of business in cash over a weekend, I don’t think we should be treated like criminals because of that,” he snaps. If Bill C-2 becomes law, he could no longer legally deposit his weekend’s revenues in one bank visit. Instead, he’d presumably have to spread it out over an entire week, a move that would require him to keep the excess cash at his store for days – raising the risk of robbery. If his cash business grows further, it might even become impossible to put all his revenues in any bank.

Beyond the aggravation and uncertainty, Morena points out the proposal is utterly redundant. All cash deposits of $10,000 or more in Canada already face strict reporting requirements overseen by the federal government’s Financial Transactions and Reports Analysis Centre (FinTRAC) specifically meant to stop money laundering. “When I go to the bank to make deposits of $10,000 or more, they take my ID and it gets reported,” Morena says. “I can prove where I got the money, so what’s the problem?”

In addition to putting an upper limit on cash transactions, Bil C-2 would forbid night drops of any value. A night drop is when a restaurant or other late-night business deposits its daily cash haul in a secure mail slot at its bank after hours. Banning this practice would add further to the inconvenience and risk for anyone dealing in cash.

But the full weight of the proposal goes far beyond just large cash deposits. If Ottawa’s new legal hassles prompt enough businesses to stop taking cash altogether, consumers will eventually be unable to use it for even the smallest purchases. If passed into law, Bill C-2’s likely consequence will be to slowly make paper money obsolete throughout the Canadian economy. Such an outcome not only ignores the many significant and long-standing advantages embodied in dealing in cash, it directly contradicts the solemn promise written on every bill the Bank of Canada prints: “Ce billet est cours légal/This bill is legal tender.” So why are the Liberals trying to put cash out of business?

How will Bill C-2 affect paper money in Canada?

In June 2025, the Liberal government introduced Bill C-2, known as the Strong Borders Bill. It aims to prohibit any person, business, bank or charity from accepting a cash payment, donation or deposit of $10,000 or more in a single or related series of transactions. It would also forbid night drops, which occur when a business drops off its daily cash earnings at a secure mail slot at a bank after hours. Both measures will add to the inconvenience of cash and raise the risk of robbery, since businesses will have to store more cash on-site. If more businesses stop accepting cash, paper money will be slowly stripped of its utility throughout the Canadian economy. This despite the solemn promise printed on every dollar bill that it is “legal tender”.

The Value of Money

As every first-year economics student is required to learn, “money” refers to any item that can fulfil three essential purposes: providing a store of value, a unit of account and a means of exchange. Many things have served this purpose across history, including livestock, gems, playing cards, precious metal, salt, shells, cigarettes and even large rocks – the famously impractical stone currency of the Pacific Ocean’s Yap Islands. Despite all the competition, printed banknotes have long proven to be money’s most flexible and convenient form.

Money’s many different forms over the centuries: Shown (clockwise from top left), The Money Changer and His Wife, by Dutch painter Quentin Massys, circa 1514; playing cards used as money in New France in the 17th and 18th centuries; a Rai money stone from the Yap Islands in the Pacific Ocean; and a wallet with Bank of Canada banknotes, all bearing the declaration: “This bill is legal tender.” (Sources of photos: (top right) Collection Nationale de Monnaies, Musée de la Banque du Canada, licensed under CC BY-SA 4.0; (bottom left) Shutterstock; (bottom right) DanLin/Canva Pro)

Money’s many different forms over the centuries: Shown (clockwise from top left), The Money Changer and His Wife, by Dutch painter Quentin Massys, circa 1514; playing cards used as money in New France in the 17th and 18th centuries; a Rai money stone from the Yap Islands in the Pacific Ocean; and a wallet with Bank of Canada banknotes, all bearing the declaration: “This bill is legal tender.” (Sources of photos: (top right) Collection Nationale de Monnaies, Musée de la Banque du Canada, licensed under CC BY-SA 4.0; (bottom left) Shutterstock; (bottom right) DanLin/Canva Pro)“The idea of paper money is very simple: everyone recognizes it and everyone accepts it,” says Jay Zagorsky, a business professor at the Questrom School of Business at Boston University and author of the 2025 book The Power of Cash, in an interview. “Not everyone can properly value a diamond, or know if a cow is healthy or sick. But we all know what a $100 bill looks like, and it is easily divisible into smaller bills.”

In spite of its timeless utility, however, cash is no longer king in the digital era. The convenience of credit and debit cards, payment apps and cryptocurrency have left banknotes looking tired and out-of-date. According to a 2024 Bank of Canada survey, the share of sales made in cash fell from 53 percent in 2009 to 20 percent in 2024. By total dollar value across the entire economy, last year cash declined to a mere 1 percent of all transactions.

The central bank reports there is a stunning $121 billion worth of Canadian bills in circulation – an all-time high. And despite the wider digital trend, 78 percent of respondents told the Bank of Canada they had no intention of going cashless.

Over the same period, the percentage of Canadians who claim they never carry cash on them zoomed from 5 percent to 21 percent. And it’s not just online purchases driving this trend. The physical world has also turned its back on cash. Many sports stadiums, including the Rogers Centre in Toronto and Calgary’s Scotiabank Saddledome, have been cash-free for years. Earlier this year Winnipeg revamped all of its on-street parking meters so that drivers must now use a smartphone to pay for parking. In July, the Bank of Nova Scotia announced that it will no longer accept cash transactions from non-clients at its branches.

Cash, however, still plays an important role in society. According to the Bank of Canada, the nominal value of money Canadians keep in their pockets and purses has more than doubled since 2009, rising from $72 to $156. (Adjusted for inflation, this represents a 30 percent increase.) Cash tucked away at home as an emergency fund has also been on the rise since the Covid-19 outbreak of 2020, with the average stash sitting at $472. As a result, the central bank reports there is a stunning $121 billion worth of Canadian bills in circulation – an all-time high. And despite the wider digital trend, 78 percent of respondents told the Bank of Canada they had no intention of going cashless.

Ottawa seems at sharp odds with this sentiment. While the Carney government recently placed some of Bill C-2’s less-controversial components into the new Bill C-12 in hopes of swifter passage, Bill C-2 remains alive on the Parliamentary order paper awaiting second reading. The October 8 press release announcing the streamlined Bill C-12 explicitly warns that, “Bill C-2 will continue…[with] new restrictions on third-party deposits, [and] large cash transfers.”

Cash Never Breaks

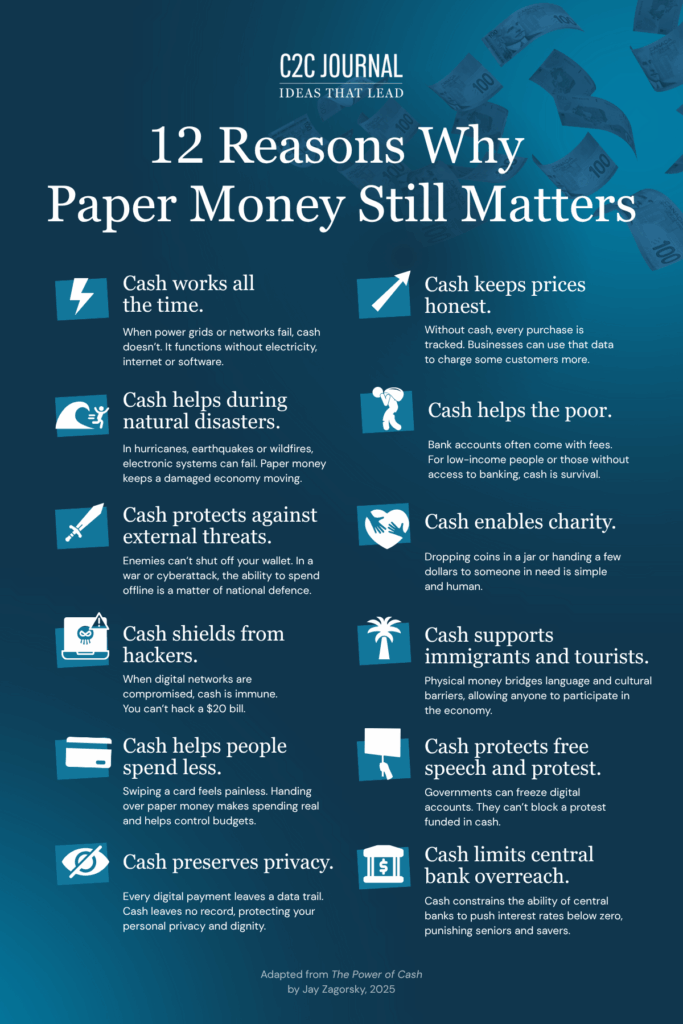

Ottawa’s ongoing anti-cash campaign either naively or deliberately overlooks the many ways in which paper money outperforms its digital and plastic simulacrums. Zagorsky’s The Power of Cash offers a full one-dozen reasons (published in the accompanying table) why maintaining cash is crucial to a fair, democratic and liberal society.

Zagorsky’s first set of benefits arises from the resilience and reliability of cash. All forms of digital or plastic money, he notes, require three things to work properly: an uninterrupted electricity supply, a functional communications network and a secure payment system. Natural disasters such as hurricanes, earthquakes or wildfires can quickly lay waste to each of these three necessities. Zagorsky cautions anyone who believes that all they need to exist is an app or a card to think carefully about what they intend to do when the next crisis hits. “If you use your cellphone to pay for everything, what will you do when the power goes out?” he asks in an interview. “After a day or two, your battery is going to die and you will be going hungry.”

Cash is also a key defence against hackers, criminals and hostile nations. Sweden is a leading candidate for the world’s “least cash-intensive country”, with paper money comprising a mere 1 percent of its total GDP. (In Canada, it’s 5 percent.) Yet in 2022, the Swedish civil defence agency sent every household a booklet called If Crisis or War Comes, which recommended that every Swede keep a healthy reserve of cash in the house in case their lives are “turned upside down” by an unforeseen disaster or war.

Just a few years ago, Ukraine was on the verge of following Sweden’s cashless path thanks to the widespread adoption of electronic payment systems and the development of a central bank digital currency called the e-hryvnia. That experiment came to a quick end once Russia invaded and began relentlessly attacking the country’s infrastructure. The National Bank of Ukraine quickly pivoted to ensuring the economy had sufficient access to paper money. “They now understand the value of cash,” Zagorsky observes.

According to a report by the European Central Bank, demand for paper money soared throughout the continent following the 2022 invasion; the closer a country was to Ukraine, the higher the demand for paper money, especially €100 and €200 notes. “National defence is not just about planes, tanks and guns,” Zagorsky explains in his book. “National defence is also about ensuring the economy continues working.” And nothing works like cash.

What’s in Your Wallet?

Paper money is useful at the personal level as well. “Cash provides people with a hard budget,” says Zagorsky. “With cash, you can only spend whatever you have on you at that moment.” With a credit card, it is possible to spend up to your entire borrowing limit, regardless of what’s in your wallet or bank account. And many do. According to a recent report from the Financial Consumer Agency of Canada, nearly one-third of Canadians have unpaid credit card balances. This propensity to overspend – something the financial services sector eagerly encourages – has even attracted an official consumer warning from Ottawa.

“What will you do when the power goes out?” The 2025 book The Power of Cash by Jay Zagorsky argues that cash is necessary to protect a resilient, fair and democratic society. (Source of screenshot: The Eclectic Economist/YouTube)

“What will you do when the power goes out?” The 2025 book The Power of Cash by Jay Zagorsky argues that cash is necessary to protect a resilient, fair and democratic society. (Source of screenshot: The Eclectic Economist/YouTube)Cash also keeps prices down for both consumers and businesses. Asked why he only accepts cash at St-Viateur’s Mile End location, bagel-maker Morena says, “It all comes down to fees.” The convenience and reward points provided by credit cards and digital payment apps are attractive to many customers, he acknowledges. But they don’t come free. Morena says he pays an average 3 percent in credit card fees on every non-cash sale he makes. “If you do a million dollars in business, that’s thirty-grand in fees right out of your pocket,” he grouses. “That money is going straight to the banks and credit card companies.”

Morena says dealing in old-fashioned paper money is actually the least expensive way to run his business, even considering the extra handling expenses it entails. “There is certainly a time factor,” to counting and sorting bills, and then taking them to the bank, he admits. But it’s nowhere near 3 percent of his gross.

Despite the low cost, however, sticking with cash forever may be a losing battle. Morena’s six other locations and his online store all accept debit, credit or other digital payments. And he may soon relent at his flagship bakery as well. “We are losing sales because of it,” he laments. “A lot of tourists don’t carry cash.” He also recognizes that the average customer spends 20 percent more at his other stores because they aren’t limited to the size of their wallets. If and when he stops being cash-only, he’ll either have to raise his prices or accept a smaller profit. The only winners will be the credit card companies.

Cash: Not Just for Capitalists

Paper money is equally popular within progressive policy circles. A 2023 report on the implications of moving away from cash by McGill University’s Max Bell School of Public Policy argues that cash is vital to meeting the needs of the less fortunate. “As we move to a cash-less society, folks who are not part of the financial network are at risk of being left behind,” says report co-author Aftab Ahmed, a public policy analyst and homeless shelter co-ordinator based in Toronto, in an interview. “The people who need and use cash are among the most vulnerable in Canadian society.”

To avoid dismantling the cash economy in small and barely perceptible steps, Ahmed recommends enacting policies to explicitly protect the right of Canadians to pay for their necessities in cash. Such measures have already been instituted in multiple U.S. cities.

About 12 percent of adult Canadians do not have a credit card, generally because they lack proper ID, sufficient income or a banking history. Shut out of the modern payment world, they must rely on cash as a matter of survival. Panhandling is also an all-cash activity. Among other folks who need cash, Ahmed notes that victims of domestic abuse are often advised to build a secret stockpile of banknotes as an untraceable “getaway fund”. Many elderly people lack the desire or ability to figure out new-fangled payment apps. And the Indigenous are particularly dependent on cash transactions; a ban on cash sales over $10,000 could pose a serious impediment to doing business on reserves.

Ahmed’s report cautions against Canada “sleepwalking” into a cash-less society. To avoid dismantling the cash economy in small and barely perceptible steps, he recommends enacting policies to explicitly protect the right of Canadians to pay for their necessities in cash. Such measures have already been instituted in multiple U.S. cities, mostly ones with left-leaning administrations including Philadelphia, New York and San Francisco. Philadelphia’s bylaw was the first and ensures that consumer goods and services such as housing, parking, online food orders and even Costco membership fees can all be paid in cash.

In Canada, the federal government appears to be doing the opposite: not sleepwalking but running full tilt towards a cashless future.

What’s Ottawa Got Against Paper Money?

The interests of the financial services industry in convincing everyone to tap for their purchases seem obvious enough – it’s how they make big money while reducing cash-handling costs. And it appears most consumers have been won over, despite the extra costs and risks it imposes on them. The fact Morena is reluctantly planning to abandon his cash-only policy suggests the marketplace values convenience above all else. But none of this explains why Ottawa seems so determined to hasten the process by legislative means.

According to the above-mentioned announcement that Bill C-2 remains a going concern, Ottawa’s clampdown on cash is meant “to target organized crime and prevent money laundering.” Such a statement equates large amounts of cash with crime and corruption. The image of cash-filled suitcases greasing the wheels of criminal organizations, buying rocket launchers and paying off dirty mayors is certainly a well-used Hollywood trope. But is it accurate?

Zagorsky devotes several chapters of his book to dismantling the notion that cash is the exclusive plaything of crooks, terrorists and tax cheats. And further, that such lowlifes would be bereft without it. “You don’t need cash to be a criminal,” he states. “If all the cash in the world magically disappeared one day, criminals would simply switch to other means.”

The assembled evidence reveals how the online world is actually far more lucrative for evil-doers than the physical one: the hauls are bigger, the chances of getting caught lower and the punishment lighter. In one fascinating chart, Zagorsky compares the amount stolen and the average prison sentence for various money-based crimes in the U.S. to create a projected “hourly wage” for financial lawbreakers. Bank robbers are at the bottom of the heap, making a measly $3 per hour for their efforts, while credit card thieves net an average of $89/hr and white-collar criminals $305/hr. When it comes to criminality, cash is for losers.

The best criminals went online a long time ago: While Ottawa claims banning large cash transactions is necessary to fight crime and prevent money laundering, that’s mostly a Hollywood myth. Shown, a scene from the 1990 movie Goodfellas featuring Joe Pesci, Robert De Niro, Ray Liotta, Paul Sorvino and a big suitcase full of cash. (Source of image: Warner Bros. Pictures)

The best criminals went online a long time ago: While Ottawa claims banning large cash transactions is necessary to fight crime and prevent money laundering, that’s mostly a Hollywood myth. Shown, a scene from the 1990 movie Goodfellas featuring Joe Pesci, Robert De Niro, Ray Liotta, Paul Sorvino and a big suitcase full of cash. (Source of image: Warner Bros. Pictures)Morena’s own experience supports the view that the best crooks have long since gone digital. “We’ve been robbed once in 68 years,” he explains. “But I have been defrauded a lot more than that in just the past ten years.” That includes having his website hacked as well as unexplained expenses showing up on his credit card bills – something that has become a familiar occurrence for almost everyone. “The criminals will always find different ways to steal from you,” he observes ruefully.

The same logic holds true for money laundering, the crime apparently at the heart of Ottawa’s cashless plans. As it turns out, paper money is not even a necessity for money launderers. The 2019 expert panel report, Combatting Money Laundering in BC Real Estate, concluded succinctly that, “Bags of cash [are] not required to launder money.” The current work of FinTRAC supports this contention. Earlier this month, for example, the federal anti-money-laundering agency announced a record $176 million fine against cryptocurrency dealer Cryptomus for failing to report thousands of transactions worth $10,000 or more in virtual currencies – the sort of suspicious activity that would in no way be impeded by a federal ban on large cash deposits.

“Canada is not going to eliminate terrorism, corruption or money laundering by making cash less available. But it will make life more difficult for people who need to use cash, and it will make Canadian society less resilient,” warns Zagorsky. Beyond scrapping the planned cash ban, he recommends raising the current reporting limit to $100,000 to better reflect the true nature of “large” cash deposits. The current $10,000 reporting level, set by Canada in 2002, simply copied a U.S. rule from the early 1970s – back when a new car cost less than $4,000. Today, $10,000 barely covers the cost of a new e-bike.

Is Canada’s Liberal government’s claim that restricting access to paper money is necessary to fight crime backed by real-world evidence?

Ottawa claims its clampdown on cash is meant “to target organized crime and prevent money laundering.” Ample evidence, however, reveals that digital thievery is far more lucrative than stealing cash. One analysis found that bank robbers average a measly US$3 per hour for their efforts, while credit card thieves make US$89/hr and white-collar criminals US$305/hr. Sophisticated money launderers and other criminals have already moved on to cryptocurrency and other digital money.

Closing the Loop

There’s considerable evidence that Ottawa does need to improve its fight against money laundering – but in ways unrelated to cash. Back in 2016 the Financial Action Task Force, an international financial crime watchdog organization, chastised Canada for its lax standards on the issue. Across 11 “effectiveness” categories, Canada’s effort was judged to be “moderate” or “low” in six. Not much has changed since then. Just last month, for example, the Liberal government finally announced the creation of a new Financial Crimes Agency meant to combat white-collar crime – an idea first proposed in the Liberals’ 2021 election platform. Given such a lethargic pace, what explains Ottawa’s sudden rush to demonize cash, and without any substantive public debate?

“If the concern is the illicit use of cash, then the government should deal with that directly and not interfere with how Canadians carry on business in their day-to-day lives,” says John Williamson, the Conservative MP for New Brunswick’s Saint John-St. Croix riding and chairman of the House of Commons’ Public Accounts Committee. While Williamson supports current FinTRAC reporting requirements and would like to see the government take stronger action against organized crime and repeat offenders, he sees no need for a sweeping ban on legitimate cash transactions.

“A lot of people in the rural parts of my riding think nothing of paying for a load of hay or a piece of used farm equipment in cash,” Williamson says in an interview. “Families in lobster fishing communities sell their product for cash, and pay their crews in cash. Canadians should be able to decide how they want to deal with their bills without government interference.” He notes that none of the four inhabited islands in his riding have a bank; without ready access to bank drafts or other modern conveniences, having plenty of cash on hand is a rural necessity.

With the possibility of a federal cash ban gaining traction at Williamson’s constituency office, his political instincts have been sparked, particularly when it comes to safeguarding personal privacy. “Cash allows people to get along with their lives free from Ottawa’s prying eyes,” he says. Which brings up Zagorsky’s final set of benefits associated with paper money: cash as a bulwark against government overreach.

By banning substantial cash transactions, the federal government is putting itself in a position to shut down future protests – or even the claimed threat of a protest – faster than it dealt with the Freedom Convoy.

Canada’s 2022 Freedom Convoy protests and the federal government’s dramatic response in freezing the bank accounts and credit cards of the protesters play a significant role in Zagorsky’s book. “A cashless society gives government the power to shut down dissent quickly,” he says firmly. “Once you eliminate cash, whatever government wants, government gets. Without cash, all dissent can be squashed immediately.” That was certainly the experience of many trucker convoy participants and supporters, who first found their crowd-sourced funds frozen, and then were unable to buy food, fuel or other necessities of life once Ottawa invoked the Emergencies Act. With that, the protest ended almost overnight.

The convoy experience provides a cautionary tale about the intersection of power and different forms of money. If a government’s response to public displays of political dissent can result in a targeted version of a natural disaster or other crisis – that is, credit cards and other forms of digital payment instantly stop working for certain people and organizations, or throughout a specified area, or for particular activities – then it makes sense to keep plenty of cash on hand for when things get ugly.

It seems Ottawa is thinking the same thing. By banning substantial cash transactions, the federal government is putting itself in a position to shut down future protests – or even the claimed threat of a protest – faster than it dealt with the Freedom Convoy. Ottawa has already proved it can take away anyone’s ability to pay for things electronically. Now, Bill C-2 offers the possibility of eliminating the only other feasible option: dealing in cash. “This closes the loop,” Williamson warns. While some protesters thought they could use “untraceable” cryptocurrency to circumvent government control, it later turned out such transactions were thoroughly scrutinized (and in some cases seized) by Ottawa. Only cash donations reliably got through.

Cash and Democracy

“This is a government that deserves no trust whatsoever from the public for the way it dealt with law-abiding protesters” during the Freedom Convoy, says Williamson. “And now this new legislation takes as its starting point the notion that anyone with a large sum of money must be a criminal. It is outrageous and utterly unbecoming for a democracy such as Canada.” Recall the three requirements of money: a store of value, a unit of account and a means of exchange. Only cash performs these functions in a truly untraceable and anonymous way, and with complete reliability. It is money at its free-est.

That cash provides a crucial defence of personal privacy and pushback against government intrusion is something many people in other countries have already realized. In Austria, for example, a 2024 petition signed by over half a million voters demanded a referendum to constitutionally enshrine their right to use cash. This movement was largely the result of a successful campaign by the opposition Freedom Party arguing the governing coalition was subtly de-emphasizing cash in order to better track Austrians’ behaviour. Prior to a referendum being held, the government agreed to amend the country’s constitution to protect cash.

Switzerland is also in the process of amending its constitution to preserve the right of citizens to pay cash for goods and services. Slovakia did the same thing in 2023. As a result of Russia’s invasion of Ukraine, most of Europe appears energized by the need to protect cash. And in Australia, the fact a government proposal to allegedly protect cash payments only applies at grocery stores and gas stations, and only for purchases under AUS$500, has been attacked by opposition politicians as a disguised effort to actually phase-out cash. The French website Cash Essentials, funded by cash-centric businesses such as the armoured car firm Loomis, offers a wealth of stories regarding the worldwide pro-cash movement.

What societal benefits does Canadian paper money provide?

Paper money – cash – defends personal privacy and acts as a powerful bulwark against government overreach. A “cashless” society in which all transactions are conducted electronically gives government much more power including, ultimately, the power to shut down dissent quickly, as demonstrated by the freezing of bank accounts and credit cards during the 2022 Freedom Convoy protests. It also acts as a social safety net: an estimated 12 percent of Canadians do not have a credit card and must rely on cash for survival. Other groups that rely on paper money include victims of domestic abuse, who are often advised to build an untraceable “getaway fund” of cash, as well as the elderly and Indigenous communities.

Spend it Wisely. And Weekly

The defence of cash appears to be that rare issue that brings together social, political and economic perspectives from across the spectrum. Cash is useful on a personal level as a budgeting tool, a check on impulse buying and an unfailingly reliable reserve of funds. Businesses like cash because it keeps their costs down and treats all customers as equals. The political left sees it as a social justice issue. The political right regards cash as a means to protect personal privacy and prevent government overreach. It bolsters national security and community resilience. It is even an environmental issue. According to Zagorsky, once a banknote changes hands a dozen times, it embodies less energy than a single electronic credit card payment. Cash is the great unifier.

‘The problem with holding cash only for emergencies is that it eventually becomes useless,’ says Zagorsky. ‘No one will know what to do with it.’ It is therefore crucial not just to hold onto cash, but to spend it regularly.

Toting up all these advantages, it’s worth considering who stands to gain from its disappearance. The list isn’t very long. There are the financial services companies that earn a cushy 3 percent or more on every transaction you make. There are online data aggregators and marketers who delight in the endless stream of personal data your digital purchases reveal. And then there’s the biggest beneficiary of all: government.

Getting rid of banknotes may boost tax revenues in the short-term by forcing everyone who currently accepts cash to report their full earnings. (Zagorsky offers several reasons why even this temporary effect may be overstated.) But it will likely do very little to reduce overall crime, drugs or terrorism. The criminal world can survive quite nicely without cash; the most skilled money launderers have already moved past suitcases of cash to cryptocurrency and other digital forms of money. This suggests the only permanent benefit to banning cash will be the dramatic improvement in a government’s ability to monitor the economic activities of every citizen and exert ever-greater control over their behaviour – including crushing and perhaps even pre-emptively deterring political dissent.

“If you want to protect the interests of the common person, then we need to keep cash,” Zagorsky warns. But simply socking away a stack of bills in your mattress won’t cut it. If cash is only kept by a few wary citizens for use during crises, then the financial and social infrastructure it requires to function will quickly wither away. “The problem with holding cash only for emergencies is that it eventually becomes useless,” advises Zagorsky. “No one will know what to do with it.” It is therefore crucial not just to hold onto cash, but to spend it regularly.

While his book contains an entire chapter listing policies to protect and improve the use of paper money – from reintroducing large-value bills and raising the reporting limit to mandating its use as an emergency preparedness measure – Zagorsky says his most powerful strategy is also the simplest. “Convince yourself and everyone you know to use paper money at least once a week,” he advises. “Buy something in cash. Anything.” That doesn’t sound too hard.

Peter Shawn Taylor is senior features editor at C2C Journal. He lives in Waterloo, Ontario.

Source of main image: Alex Segre/Shutterstock.