When Justin Trudeau became Prime Minister in 2015, he stated his government would incur a “modest short-term deficit” of less than $10 billion in each of its first three years and promised a balanced budget by fiscal 2020. But despite having inherited improving national finances from his Conservative predecessor that were on-track towards a balanced budget in another year or two, Trudeau then ran nine consecutive deficits, the last reaching $61.9 billion in fiscal 2024 – nearly doubling Canada’s accumulated federal debt from $650 billion to $1.24 trillion.

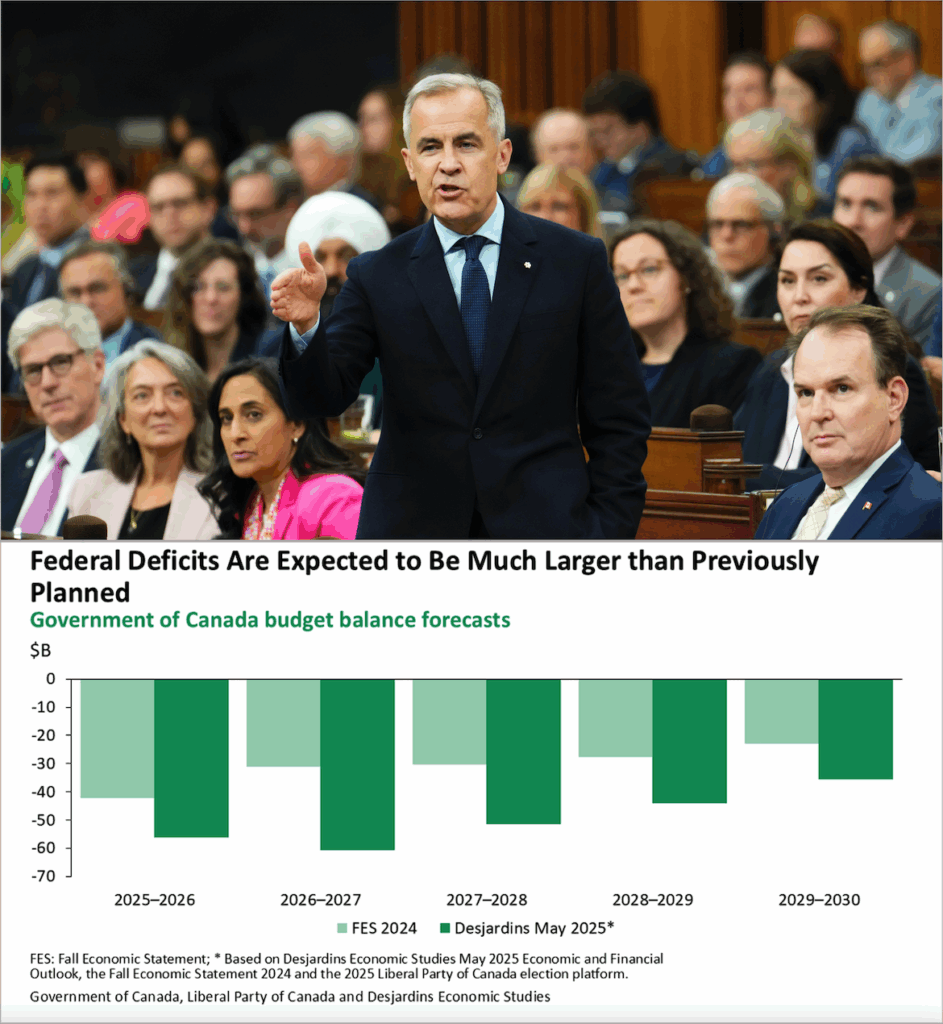

Who could have imagined that a supposedly prudent and ultra-competent former governor of two central banks would make Trudeau look frugal by comparison? The Government of Canada’s recently released spending plan, formally known as the Main Estimates, shows that spending in the fiscal year ended March 31, 2026 will increase by a further 8.5 percent over the current fiscal year to $437.8 billion, plus $74.1 billion in “non-budgetary spending” such as EI payouts, plus at least $49 billion to service the burgeoning national debt. After a couple of other calculations peculiar to the Main Estimates, this yields total planned expenditures of $554.5 billion during Mark Carney’s first year in office.

Even if tax revenues were to remain level with last year, that implies a $40 billion deficit. But given the tariff wars ravaging Canada’s automobile, metals, appliances and consumer goods sectors, the Carney government is facing an all-but certain decline in revenue. Further increasing public spending in the face of these realties will surely result in a record-setting deficit easily exceeding 3 percent of Canada’s GDP and thus dwarfing our meagre annual economic growth.

During Trudeau’s time in office, the Canadian dollar’s foreign exchange value fell from US$0.77 to US$0.696 on January 6, 2025 – the day he finally resigned as Prime Minister. To signal that his departure heralded a new era of fiscal responsibility, much was then made of Carney’s directives that federal departments look for savings and trim staff. But amidst Canada’s daunting financial challenges, such marginal measures are utterly trivial – if they are being implemented at all. Carney’s stunning plan now to actually increase spending will both accelerate inflation and push the international value of our currency down once more.

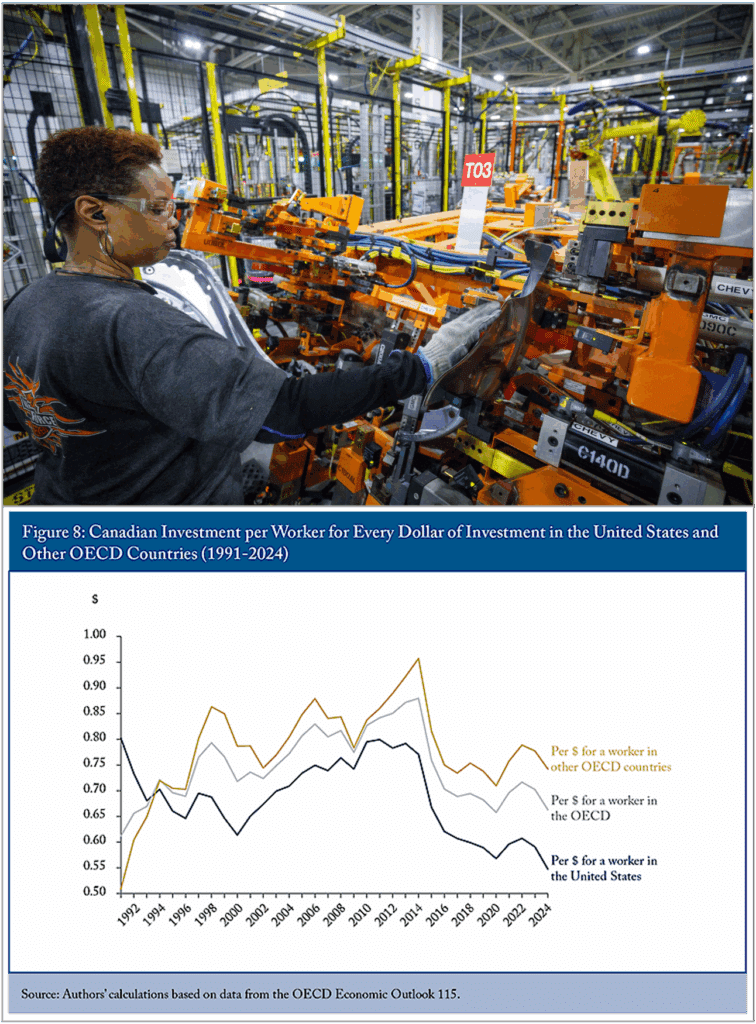

‘When businesses invest, they equip workers with better tools, driving productivity and, in turn, higher earnings and improved living standards. The fact that Canadian workers are increasingly underequipped compared to their peers abroad signals less competitiveness and lower wages – a threat to our quality of life.’

In a recent article entitled “Mark Carney Was Right: He’s Not Justin Trudeau. He Spends More”, Franco Terrazzano of the Canadian Taxpayers Federation points out that Carney’s intensification of Trudeau’s debt-fuelled spending spree will raise interest costs precipitously. “The Main Estimates say that this year the government will spend $49 billion on interest [and] the Parliamentary Budget Officer projects interest charges blowing a $70-billion hole in the budget by 2029,” Terrazzano warns. “This spending spree means Canadians’ kids and grandkids will be making payments on Ottawa’s debt for the rest of their lives.”

That brings us to the matter of our country’s credit rating. A nation’s credit rating is vital both for accessing capital markets and determining the interest rate paid; it also carries powerful symbolic value that influences investors’ opinion about a country’s overall economy and investment climate. A recent report by New York-based credit rating firm Fitch Ratings, Inc. provides a warning. “Canada has experienced rapid and steep fiscal deterioration, driven by a sharply weaker economic outlook and increased government spending during the [recent] electoral cycle,” the report states. “If the Liberal program is implemented, higher deficits are likely to increase federal, provincial and local debt to above 90% of GDP.” Although Fitch didn’t yet downgrade its rating for Canada, the firm’s message is clear.

Canadian voters need to stop looking “south” for an easy explanation and – a scapegoat – for our nation’s woes. The Canadian economy was in deep trouble long before Donald Trump’s tariff wars. Business investment per worker is a key predictor of a nation’s evolving productivity and, ultimately, its overall standard of living. “Capital available per Canadian worker has been shrinking since 2015,” warns a recent C.D. Howe Institute media release. Headlined “Canada’s Capital Crisis: The Growing Threat of Falling Business Investment to Productivity”, it continues: “When businesses invest, they equip workers with better tools, driving productivity and, in turn, higher earnings and improved living standards. The fact that Canadian workers are increasingly underequipped compared to their peers abroad signals less competitiveness and lower wages – a threat to our quality of life.”

What was the state of the Canadian national debt at the end of Justin Trudeau’s time in office?

Justin Trudeau’s Liberal government ran nine consecutive budget deficits, nearly doubling the Canadian national debt to $1.24 trillion, up from $650 billion. His final deficit in fiscal 2024 reached $61.9 billion. During his time in office, the Canadian dollar’s value fell from US$0.77 to US$0.696 on January 6, 2025 – the day he resigned as Prime Minister.

How did Canada fall so far behind? The answers to that question are clearly implied in the report’s list of needed reforms:

- Reform corporate taxes to encourage (rather than discourage) capital investment.

- Implement a tax incentive for early investment.

- Reduce the regulatory barriers that have stymied or delayed natural resource-based projects, particularly oil and natural gas developments.

- Promote investment in intellectual property through targeted tax incentives.

- Fix policy uncertainty and streamline regulatory processes to create a predictable investment environment.

During the spring federal election campaign, Canadians were inundated with TV and social media ads reminding voters that Carney had headed the Bank of Canada throughout the 2008 financial crisis, implying if not outright boasting that Carney had personally made the decisions enabling Canada to come out the other side in better fiscal shape than other countries. In truth, the key decisions were made by Conservative Prime Minster Stephen Harper and, as Harper himself reminds people to this day, his excellent Finance Minister, the late Jim Flaherty. It was their decisions – operating with only a fragile minority government, no less – as well as the previous decade-plus of sound fiscal management, that kept Canada solvent during the worst global financial crisis since the Second World War.

Now that we see the impact of Prime Minister Carney’s wild spending spree in the face of a trade crisis affecting virtually all government revenues, I’m reminded of former UK Prime Minister Liz Truss’s opinion that Carney “did a terrible job” in her country, being the “governor of the Bank of England who printed money to a huge extent, creating inflation.” At least back in Canada, bank governor Carney didn’t actually wreck the work Harper and Flaherty were attempting to do. So which role might he now reprise as Prime Minister?

Who was the real saviour? Some credit Carney – including Carney himself – for steering the country through the 2008 financial crisis while he was Bank of Canada Governor; in fact, Conservative Prime Minister Stephen Harper and his Finance Minister, Jim Flaherty, made the key decisions. Shown at left, Harper (right) with Flaherty about to deliver the 2008 budget speech. (Sources of photos: (left) The Canadian Press/Sean Kilpatrick; (right) Financial Times)

Who was the real saviour? Some credit Carney – including Carney himself – for steering the country through the 2008 financial crisis while he was Bank of Canada Governor; in fact, Conservative Prime Minister Stephen Harper and his Finance Minister, Jim Flaherty, made the key decisions. Shown at left, Harper (right) with Flaherty about to deliver the 2008 budget speech. (Sources of photos: (left) The Canadian Press/Sean Kilpatrick; (right) Financial Times)There are those who think – or perhaps merely hope – that Carney is genuinely committed to strengthening Canada’s economy and will govern in a relatively non-ideological, responsible way that focuses above all on getting large new projects built and driving economic growth. Ten days ago, Robert Lyman and George Koch laid out something of a road map for how a “sensible” version of Carney might set about doing so. Well, I’ve been reading the same signs, watching the same announcements and listening to the same statements, and I simply don’t buy it.

Surely, part of any such “sensible” stance would include trying to wrestle down the federal deficit by making real cuts to expenditures, especially to Trudeau-era programs that do nothing to foster productivity or economic growth. But as I showed above, not only are there no signs of any such belt-tightening, Carney is moving in the opposite direction. At the recent G7 Summit, for example, Carney casually announced $4.3 billion in new aid for Ukraine that had no budgetary authority at all. Personally, I’m convinced Carney is even worse than Trudeau and will steer Canada’s ship of state into a fiscal abyss.

What are the future spending commitments made by Mark Carney’s Liberal government, and what are their potential impact on the Canadian economy?

The government’s published spending plan, known as the Main Estimates, shows an 8.5 percent increase in spending for the fiscal year ending March 31, 2026, to $437.8 billion, plus $74.1 billion in “non-budgetary spending” such as EI payouts and at least $49 billion to service the Canadian national debt. After a couple of other calculations peculiar to the Main Estimates, this yields total planned expenditures of $554.5 billion.

On top of that, Carney made new commitments on NATO spending, first to 2% of GDP this fiscal year and then to 5% of GDP by 2035. This will push Canada’s defence spending to the equivalent of $155 billion per year in today’s dollars. All this extra spending could jeopardize Canada’s credit rating, worsen the Canadian inflation rate and reduce the value of Canadians’ savings.

His recent moves regarding national defence are especially worrying. On June 9, under pressure from the very President he had promised to take on “elbows up”, Carney announced that Canada would fulfill the NATO policy that member nations spend 2 percent of their GDP on national defence – and would do so this fiscal year. Given that Canada’s nominal GDP is approximately $3.1 trillion in current dollars, that will mean almost instantly raising defence spending to about $62 billion – $27 billion or 77 percent higher than contemplated in the Liberal election platform and the recently published Main Estimates. Every dollar of that will add to the deficit, this year and for every year to come.

Carney’s spending plans threaten to create an all-but unmanageable fiscal mess, jeopardizing Canada’s important credit rating. It pains me to say that Canadians face a continuation of declining living standards and inflationary reduction in the value of their hard-earned savings.

Then last week, Carney upped the ante by almost unbelievably pledging that Canada would match the new NATO spending target of 5 percent of GDP. If he and his Liberal colleagues follow through, Canada’s defence spending will balloon to the current annual equivalent of $155 billion. This is utterly unaffordable, obviously, and in my view is more revelatory of Carney’s true impulses than any hopes he might govern “sensibly”.

Millions of Canadians were fooled by Mark Carney’s image as the great global banker, the serious and experienced technocrat who could safeguard Canada’s vital interests in going eyeball-to-eyeball against Trump. That image is starting to crack. Instead of respecting Carney, Trump is almost toying with him, last Friday announcing on social media that the U.S. was pulling out of the much-ballyhooed bilateral trade talks launched at the G7 Summit less than two weeks earlier – and brusquely adding that Carney would find out the new tariff rates on Canadian goods in the following seven days.

Why is falling business investment a concern for the Canadian economy?

Meanwhile, Carney’s spending plans threaten to create an all-but unmanageable fiscal mess, jeopardizing Canada’s important credit rating, which S&P Global Ratings still has at AAA, with Fitch at AA+. It pains me to say that Canadians face a continuation of declining living standards and inflationary reduction in the value of their hard-earned savings. We can only hope for an early election that unseats Carney’s nation-impoverishing minority government.

Gwyn Morgan is a retired business leader who was a director of five global corporations.

Source of main image: Shutterstock.